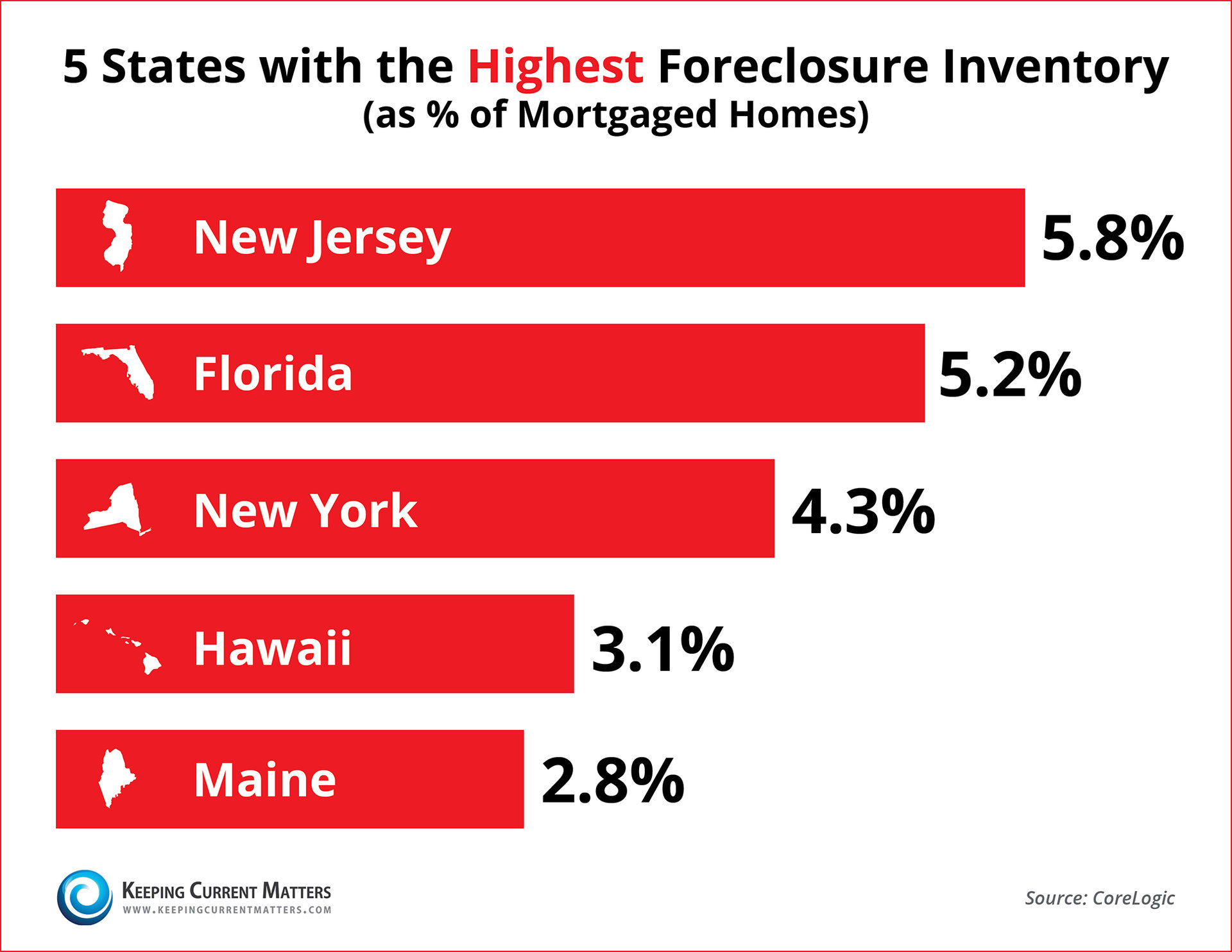

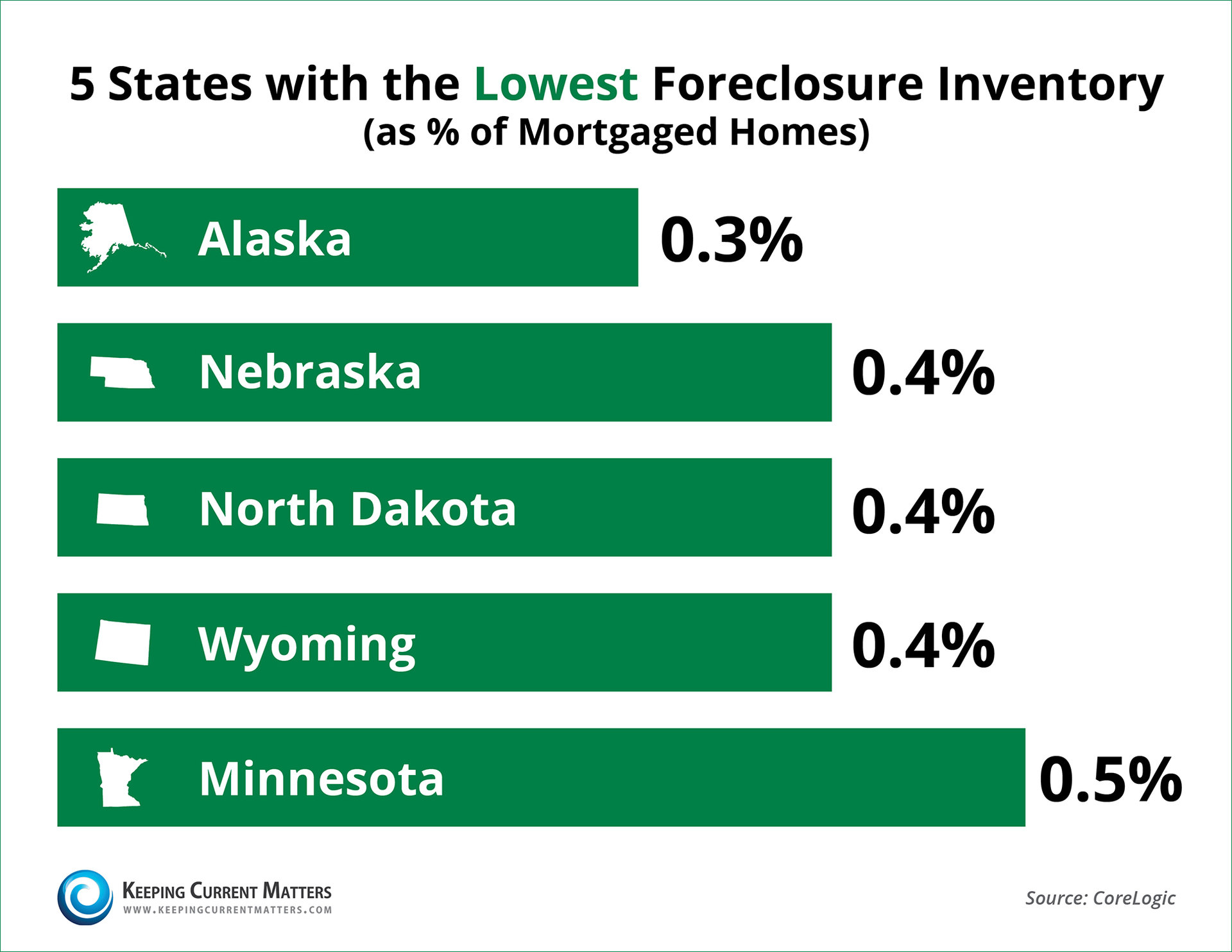

According to the latest CoreLogic National Foreclosure Report, “approximately 660,000 homes in the US were in some state of foreclosure as of May 2014”. This figure is down 37% from the 1 million homes in May of 2013. May marked the 31st consecutive month in which there were year-over-year declines. Mark Fleming chief economist for CoreLogic revealed: “Significant gains have been made in the last year to reduce the foreclosure stock. Yet, these improvements are occurring disproportionately in non-judicial states. The foreclosure inventory in judicial states is averaging 2.1% which is more than twice the 0.9% average that is occurring in non-judicial states.” The foreclosure process in the twenty-two judicial states can take, on average, anywhere from 180-400 days according to the Mortgage Bankers Association. The lack of initial court intervention in non-judicial states, often means that the process of foreclosure takes significantly less time. Therefore, judicial states as a whole, have taken longer to catch up to the rest of the country in liquidating foreclosure inventory. All five states with the highest foreclosure inventory as a percentage of mortgaged homes are judicial states.  On the list of the five lowest inventory states, only North Dakota uses a judicial process.  Bottom LineEven though some states have not recovered completely from the foreclosure crisis, the nation as a whole is on the right track as inventory decreases. |

Thursday, July 24, 2014

Foreclosure Inventory Down 37% over Last Year!

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment