See for yourself!

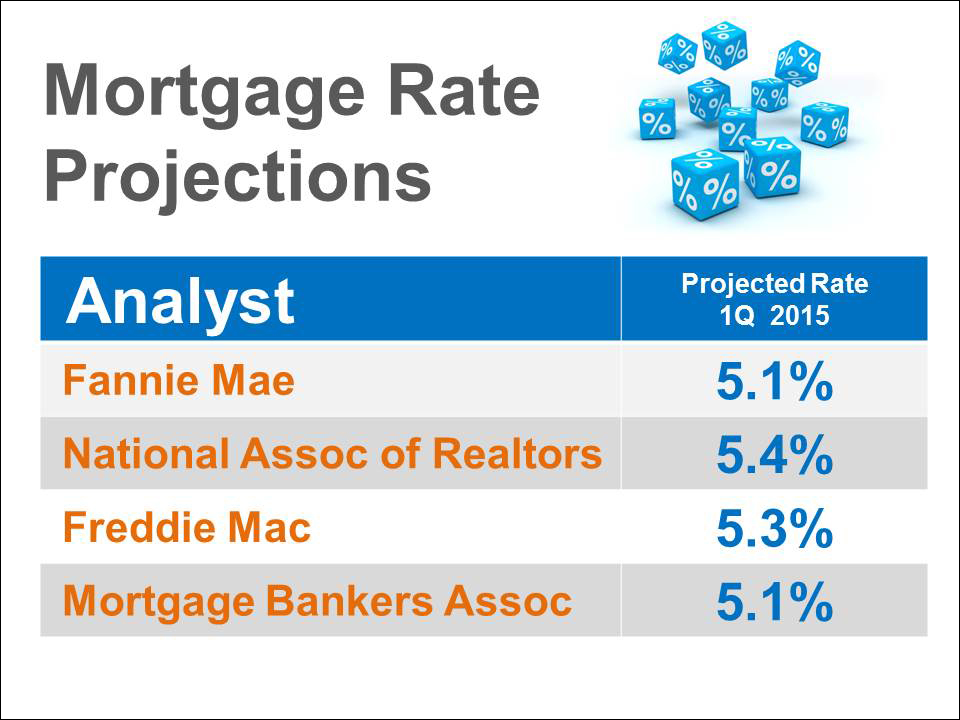

| Mortgage Rates Projected to Rise as Tapering Continues Posted: 18 Feb 2014 04:00 AM PST  It is projected that if the Fed continues to cut back on bond purchases that long term mortgage rates would start to climb. Many experts felt that Janet Yellen, who replaced Ben Bernanke as Fed Chair, was going to be less inclined to continue tapering bond purchases at the level established. It is projected that if the Fed continues to cut back on bond purchases that long term mortgage rates would start to climb. Many experts felt that Janet Yellen, who replaced Ben Bernanke as Fed Chair, was going to be less inclined to continue tapering bond purchases at the level established.However, in her testimony in front of the Financial Services Committee last week, Yellen made it quite clear that she will in fact continue the current pace of tapering: “In December, the Committee judged that the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions warranted a modest reduction in the pace of purchases, from $45 billion to $40 billion per month of longer-term Treasury securities and from $40 billion to $35 billion per month of agency mortgage-backed securities. At its January meeting, the Committee decided to make additional reductions of the same magnitude. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.” What does that mean to a prospective purchaser? Currently, Freddie Mac’s 30 year rate is at 4.28%. Here are the projected interest rates for this time next year:  |

| Buying a Home: Should You Do it Now or Later? Posted: 11 Feb 2014 04:00 AM PST  Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year. Last month, the Federal Reserve, in a unanimous vote, decided to further decrease its bond purchasing. The bond purchases were the government’s stimulus package created to keep long term mortgage interest rates artificially low in order to help drive the housing market. Most experts believe that tapering will cause interest rates to increase as we move through the year.Interest rates have remained relatively stable since the onset of the tapering in December. This is probably because the first round of increases had already been ‘priced into’ the equation last summer when rates skyrocketed by over a full percentage point just on the speculation that tapering would take place later in 2013. However, as we move forward, most analysts believe rates will start to rise culminating in a rate close to a full percentage point higher than current rates by this time next year. For example, Freddie Mac, Fannie Mae, The Mortgage Bankers’ Association and the National Association of Realtors have all recently projected rates to be between 5-5.4% at this time next year. Bottom LineIf you are a first time buyer or a move-up buyer, the cost of the mortgage on your new home will probably increase as we move through the year. If the timing makes sense, buying sooner rather than later may save you a substantial amount of money over the long term in lower mortgage payments. |

VA loans are the most misunderstood mortgage program in America. Industry professionals and consumers often receive incorrect data when they inquire about them. In fact, misconceptions about the government guaranteed home loan program are so prevalent that a recent VA survey found that approximately half of all military veterans do not understand it.

VA loans are the most misunderstood mortgage program in America. Industry professionals and consumers often receive incorrect data when they inquire about them. In fact, misconceptions about the government guaranteed home loan program are so prevalent that a recent VA survey found that approximately half of all military veterans do not understand it. Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five reasons purchasers should consider buying before the spring market arrives:

Based on prices, mortgage rates and soaring rents, there may have never been a better time in real estate history to purchase a home than right now. Here are five reasons purchasers should consider buying before the spring market arrives: