The following article is by Mark Daly, managing director and investment officer, Daly & Vacek Investment Consulting Group. From the Idaho Statesman's Business Insider April 2015.

Read on for a great overview of the importance of home ownership in connection with the other investment options.

"Our investment consulting practice allows us the privilege of rendering advice beyond the traditional realm of stocks and bonds, mutual funds, retirement and education planning, and regular saving and investing. That includes ownership in productive real estate, and for most people starting out, that means a home.

The home offers a good chance for price appreciation. A balance between liquid assets like equities, fixed income securities and cash can complement less-liquid assets like a primary residence, business or commercial property.

My daughter and her fiance plan to marry this fall, and the topic of future home ownership has come up recently. The couple participates in a 401(k) plan at work, and both contribute enough to receive the employer matching contribution. Their next investment, in addition to after-tax savings, could be a home. From a planning perspective, we balance the expense of home ownership with other goals such as education funding, retirement, travel and ongoing cash needs.

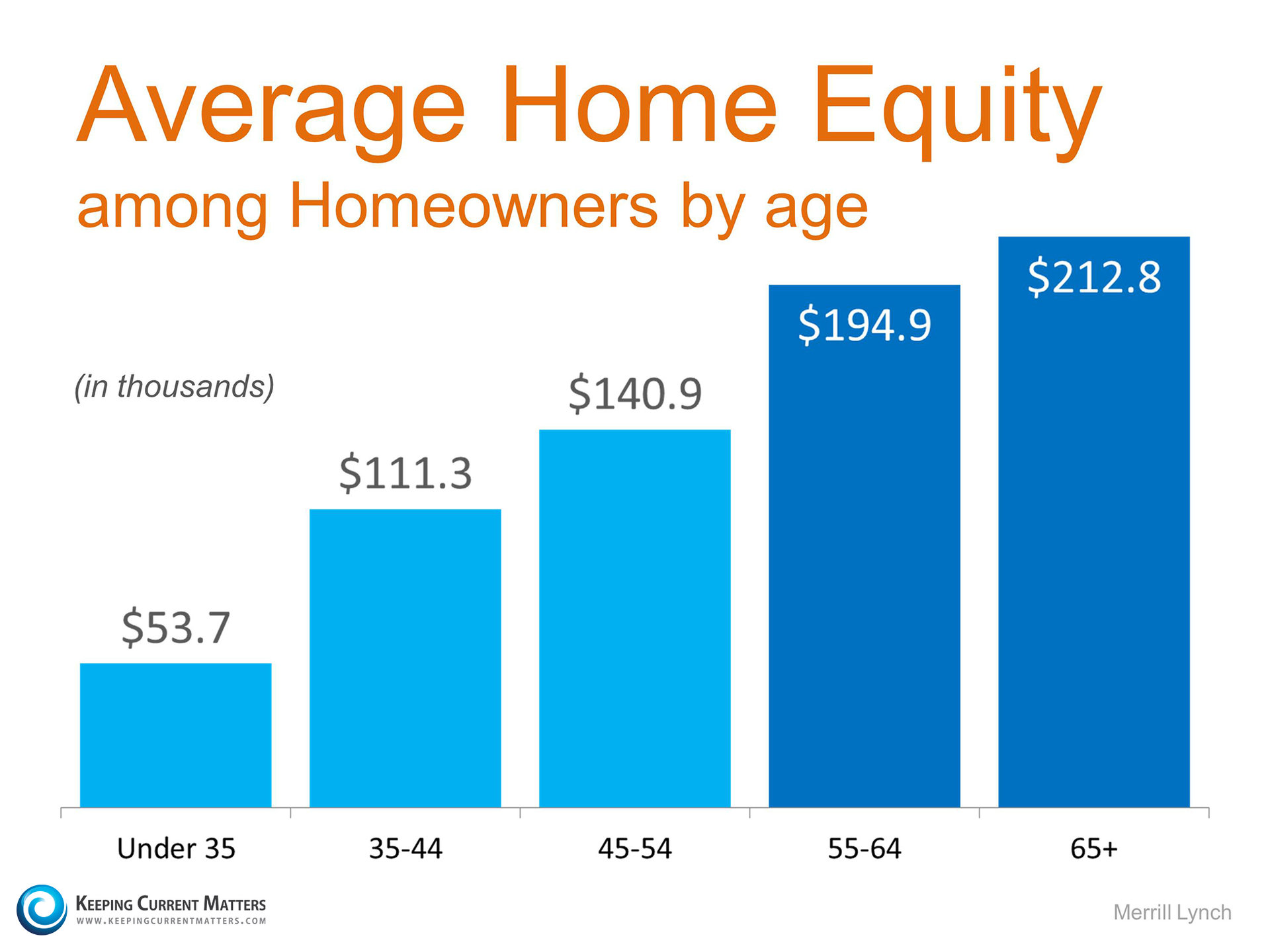

First and foremost, a strategy to own the home outright, with a zero mortgage balance at retirement, is essential.

The planning process is the starting point for balancing multiple financial goals by illustrating the tradeoffs and demands on a finite amount of after-tax cash flow. The ability to prioritize and set realistic expectations about what is possible is a critical element of planning. Retire early or accept normal retirement age? Send kids to a private university or state school? Fund annual vacations or accept less frequent holiday travel?

When contemplating the purchase of a home, financial responsibility must be considered. This would include the ability to pay off not only mortgage interest and principal but also property taxes and homeowners insurance.

Ongoing maintenance and repairs will be required to keep the property in top condition, maintain value and allow possible resale. Selling does not always occur at the ideal time, especially when market conditions are depressed. Renting can make more sense if the job market is unstable or if relocation will be needed to obtain employment or remain employed. Various calculators are available to compare the cost of owning versus renting, and these should be used before making a decision.

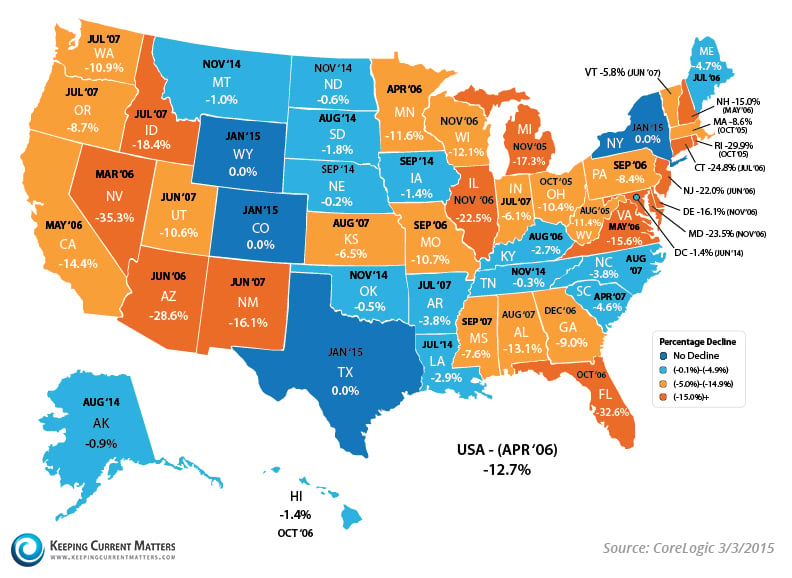

Home ownership, loan qualifications and borrowing standards have changed dramatically since the credit crisis of 2008. Mortgage rates are low by historical measure, and down payments in the low-single-digit percentages are common. But even low interest rates compound over time, adding to the total cost of owning and buying a home. Record foreclosures after 2008 remind us that debt and leverage should be used wisely when economic conditions turn down.

The American dream remains the possibility of home ownership. Young people with wage income and clean credit history are qualifying like never before. Our advice is to take your time, plan carefully, consider the risk, don’t over-borrow, and be patient when considering this important financial decision."

Boise's Northend, 3 Bedroom, 2.5 Bath, 2185 Square Feet, Price $479,900

Boise's Northend, 3 Bedroom, 2.5 Bath, 2185 Square Feet, Price $479,900 Boise's Northend, New Construction, Price $442,000, 1967 Sq. Ft, 3 Bd, 2.5 Bath

Boise's Northend, New Construction, Price $442,000, 1967 Sq. Ft, 3 Bd, 2.5 Bath HUGE home in Eagle on 1 Acre, 7743 Square feet, 7 Bedrooms, 6 Bths, Price $929,000

HUGE home in Eagle on 1 Acre, 7743 Square feet, 7 Bedrooms, 6 Bths, Price $929,000 View Home in Quail Ridge, 2504 Sq. Ft., $399,000 4 Bed, 3 Baths

View Home in Quail Ridge, 2504 Sq. Ft., $399,000 4 Bed, 3 Baths You can see more details on any of these on my website lowesflatfee.com or contact me.

You can see more details on any of these on my website lowesflatfee.com or contact me.

If you are debating purchasing a home right now, you are surely getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home. There are 3 questions you should ask before purchasing in today’s market:

If you are debating purchasing a home right now, you are surely getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home. There are 3 questions you should ask before purchasing in today’s market:

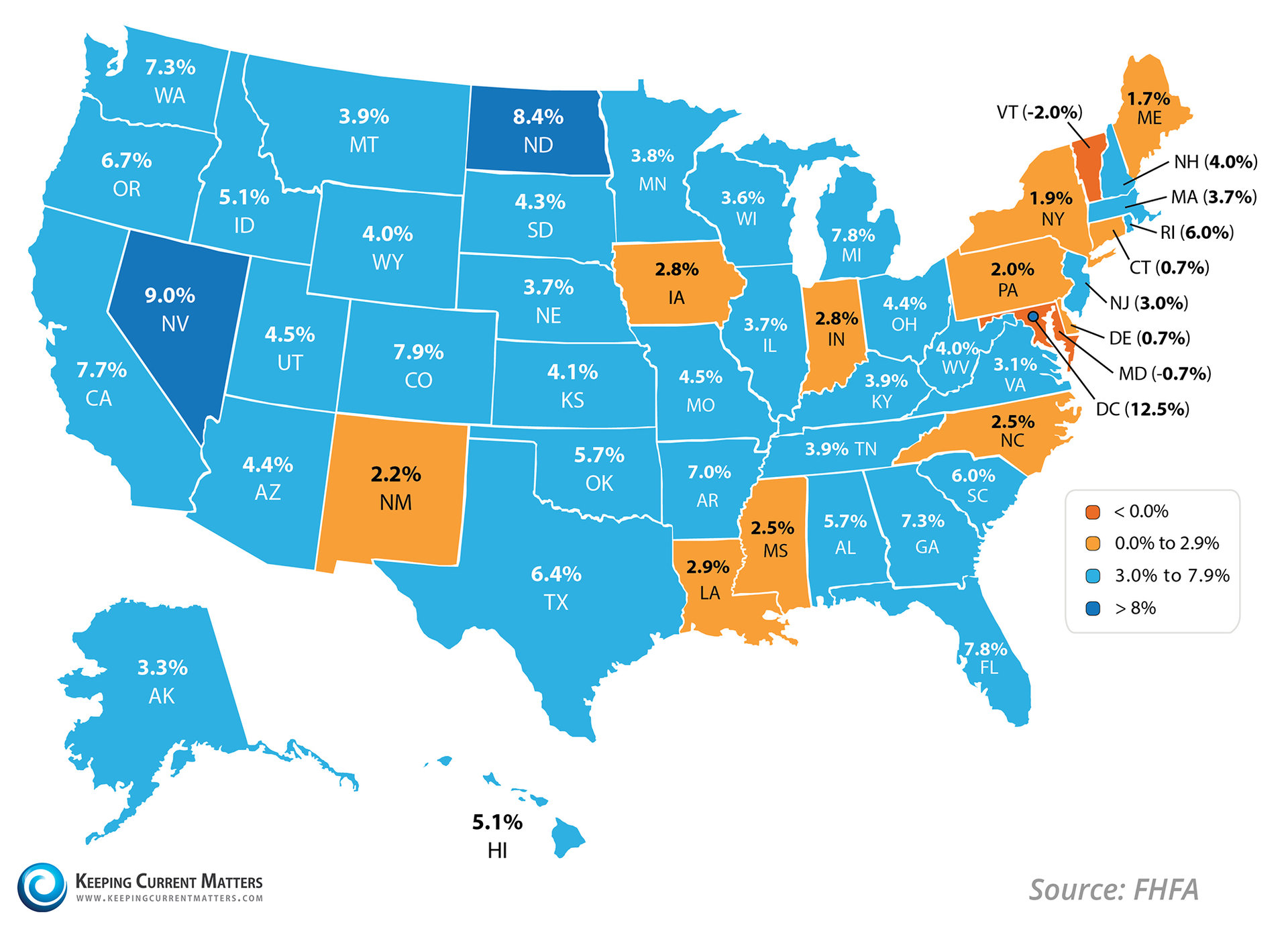

According to Nationwide’s recently unveiled, Health of Housing Market (HoHM)

According to Nationwide’s recently unveiled, Health of Housing Market (HoHM)

A recent Demand Institute

A recent Demand Institute

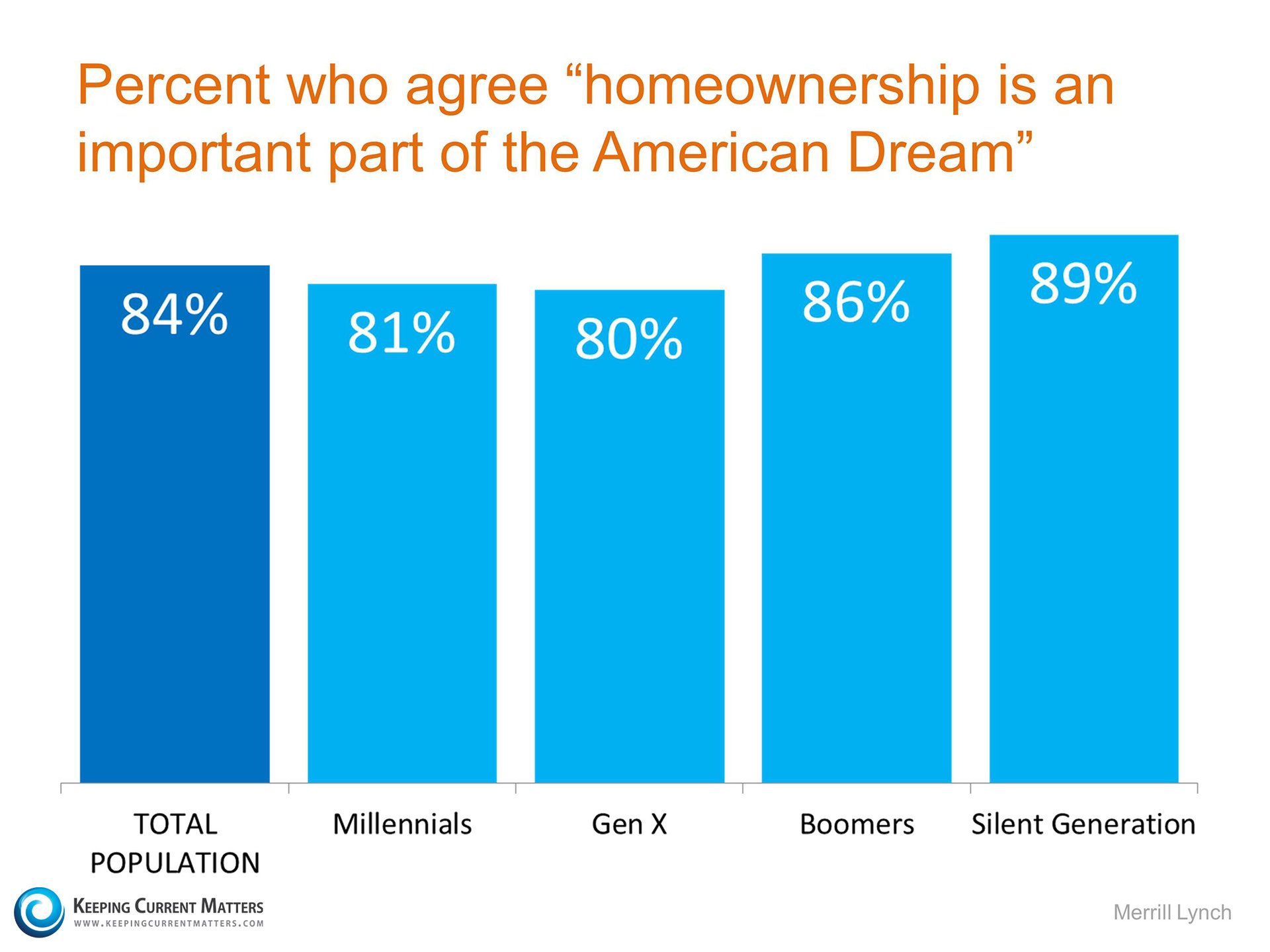

There have been some who have voiced doubt as to whether or not the younger generations still consider buying a home as being part of the “American Dream”. A recent

There have been some who have voiced doubt as to whether or not the younger generations still consider buying a home as being part of the “American Dream”. A recent

Every home must be sold TWICE! Once to the buyer, and once to the bank appraiser if a mortgage is involved.

Every home must be sold TWICE! Once to the buyer, and once to the bank appraiser if a mortgage is involved.

If you are one of the many homeowners out there who are debating putting their home on the market in 2015, don’t miss out on the opportunity that currently exists. There will be significantly less competition in the winter months than in the spring. According to the

If you are one of the many homeowners out there who are debating putting their home on the market in 2015, don’t miss out on the opportunity that currently exists. There will be significantly less competition in the winter months than in the spring. According to the