Pending home sales declined in September for the fourth month in a row, a signal to expect lower home sales this quarter and a flat trend going into next year, a trade group said Monday.

The pending home sales index, a forward looking indicator, fell 5.6% to 101.6 in September from a downwardly revised 107.6 in August and is 1.2% below last year's level, the National Association of Realtors says.

That the index is lower than last year marks the firs time that's occurred in 29 months, NAR says.

"This tells us to expect lower home sales for the fourth quarter," says Lawrence Yun, NAR chief economist. Even so, he expects prices to continue to rise, but at a slower pace -- echoing expectations of many housing watchers and other economists.

Higher mortgage interest rates and home prices curbed consume buying power, NAR says. The government shutdown also played a role, as government and contract workers were on the sidelines.

Thursday, October 31, 2013

Monday, October 28, 2013

Reality TV is not really reality!

Have you ever watched those house buying shows on TV? My wife watches occasionally and I will come in and see a bit and it drives me crazy! It is certainly not life as I know it. So if you came to buy a house, and I tell you you I will let you choose out of 3 homes, how would that go over? Or you tell me you have a maximum budget of $300,000, and I proceed to show a house priced at $395,000?

And while I am on that subject of reality, all the automatic house payment calculators out there which fail to include taxes, hazard insurance and mortgage insurance. Or the on-line house value estimators, yes Zillow I am talking about you, which many times are not even in the right ball park.

I found this graphic from the KCM Blog that compares some of the myths vs. reality.

Bottom Line: Reality TV may be entertaining, but it is not reality! (And online payments and values can give some background but ask a professional before you start making a decision.)

Bottom Line: Reality TV may be entertaining, but it is not reality! (And online payments and values can give some background but ask a professional before you start making a decision.)

And while I am on that subject of reality, all the automatic house payment calculators out there which fail to include taxes, hazard insurance and mortgage insurance. Or the on-line house value estimators, yes Zillow I am talking about you, which many times are not even in the right ball park.

I found this graphic from the KCM Blog that compares some of the myths vs. reality.

Bottom Line: Reality TV may be entertaining, but it is not reality! (And online payments and values can give some background but ask a professional before you start making a decision.)

Bottom Line: Reality TV may be entertaining, but it is not reality! (And online payments and values can give some background but ask a professional before you start making a decision.)

Friday, October 25, 2013

Vacancy Report

Thursday, October 24, 2013

Forbes: Buy Now or Pay More Later?

Even though no one at KCM actively lists or sells real estate, some of our readers believe that there is an inherent basis toward the real estate community in our writing. For that reason, we want to quote a third party source today.Forbes, in their online edition last week, spoke to the importance of buying a home now rather than waiting.

Even though no one at KCM actively lists or sells real estate, some of our readers believe that there is an inherent basis toward the real estate community in our writing. For that reason, we want to quote a third party source today.Forbes, in their online edition last week, spoke to the importance of buying a home now rather than waiting.The article, Should You Buy a Home Now or Pay More Later?, explains:

“With mortgage rates creeping up toward 5% as 2013 draws to a close, potential home buyers have some decisions to make — and soon.

The danger for potential homebuyers isn’t that mortgage rates are nearing 5.00%; the real threat is that rates could go higher, to 5.50% or even 6.00% in 2014.”

The article spells out the financials consequences a buyer would face by waiting. ($67,746 on a $300,000 mortgage).

They gone on to identify four things a buyer should take into consideration before delaying a decision to purchase.

- Rates will likely rise — and soon with 5% interest rates right around the corner.

- The Federal Reserve will stop “tapering” causing rates to return to historically normal levels (6-7%).

- Home values are rising

- The autumn buying season is underrated “as you can take advantage of year-end tax breaks and the fall weather makes it an ideal time to move”.

Bottom Line

The financial advice Forbes gave to their readers was rather simple. Buy now or pay more later!!

Thanks to KCM Blog for this timely advice, and to Forbes. If you are ready to head the advice, give me a call or shoot me an email and I'll get searching for your new home TODAY!

Wednesday, October 23, 2013

10 Hidden Hazards When Buying Foreclosures

I have sold several foreclosures over the past few years, and buyer's have generally been pleased with their purchases with a minimum amount of surprises. (Some surprises never the less!) But one must always use caution and do their due diligence. The following article from KCM Blog lists 10 potential hazards of which a foreclosure should be aware.

10 Hidden Hazards When Buying Foreclosures  Buying a foreclosed home can seem like a dream. What could be better than getting a home for a fraction of the market value? Some may even say that the deals sound like they could be too good to be true. In some cases, those doubters aren't too far off the mark. There are some hidden dangers in buying foreclosure properties that, if you're not aware of them, could be disheartening and disappointing. If you are pursuing this route in buying your new home, be sure to look out for these hazards and hidden costs. Buying a foreclosed home can seem like a dream. What could be better than getting a home for a fraction of the market value? Some may even say that the deals sound like they could be too good to be true. In some cases, those doubters aren't too far off the mark. There are some hidden dangers in buying foreclosure properties that, if you're not aware of them, could be disheartening and disappointing. If you are pursuing this route in buying your new home, be sure to look out for these hazards and hidden costs.

In short, buying a foreclosed property can be a great way to save money. However, be sure to look into all the potential costs involved before making a final decision. Do the math to determine if you will really wind up saving, or if the property will end up costing you when all is said and done. |

Tuesday, October 22, 2013

TO DO LIST-when buying a home.

| ||||

|---|---|---|---|---|

| ||||

|

I found this to be a brief but useful reminder. Thanks to Sohayl Saboori of Eagle Home Mortgage.

Monday, October 21, 2013

Strategic Defaulters in Fannie and Freddie's Crosshairs

Fannie Mae and Freddie Mac are looking to collect unpaid mortgage debt from “strategic defaulters,” those underwater home owners who skipped out on their mortgages even though they had the ability to pay.

If a home is sold at foreclosure but the proceeds don't cover the outstanding balance of the home owner's loan, the mortgage giants can pursue judgments against the home owner forcing him or her to pay the deficiency. And the Federal Housing Finance Agency, which regulates Fannie and Freddie, is pushing them to step up their efforts to do just that.

The FHFA says Fannie and Freddie haven’t been aggressive enough in going after strategic defaulters, and the inspector general's office notes that the GSEs could cut their losses by making it more of a priority. The inspector general’s office estimates that Fannie and Freddie could recoup billions of dollars if they made strategic defaulters pay up. So far, the office has found that Freddie Mac did not refer 58,000 foreclosures — estimated deficiencies of $4.6 billion — for collection.

Some states do not allow deficiency judgments, but in more than 30 states and the District of Columbia, they are permissible. The FHFA says it will more closely monitor how effective Fannie Mae and Freddie Mac are in collecting deficiency judgments.

What I read was that Idaho allows deficiency judgements, BUT they must be filed within 90 days of the foreclosure. (I am not an attorney and am only repeating what I have read, I do not know if it is accurate and you are encouraged to consult an attorney if this may apply to you.) So you should beware if you are looking at a coming up short-sale or foreclosure and you have the ability to pay the debt.

If a home is sold at foreclosure but the proceeds don't cover the outstanding balance of the home owner's loan, the mortgage giants can pursue judgments against the home owner forcing him or her to pay the deficiency. And the Federal Housing Finance Agency, which regulates Fannie and Freddie, is pushing them to step up their efforts to do just that.

The FHFA says Fannie and Freddie haven’t been aggressive enough in going after strategic defaulters, and the inspector general's office notes that the GSEs could cut their losses by making it more of a priority. The inspector general’s office estimates that Fannie and Freddie could recoup billions of dollars if they made strategic defaulters pay up. So far, the office has found that Freddie Mac did not refer 58,000 foreclosures — estimated deficiencies of $4.6 billion — for collection.

Some states do not allow deficiency judgments, but in more than 30 states and the District of Columbia, they are permissible. The FHFA says it will more closely monitor how effective Fannie Mae and Freddie Mac are in collecting deficiency judgments.

What I read was that Idaho allows deficiency judgements, BUT they must be filed within 90 days of the foreclosure. (I am not an attorney and am only repeating what I have read, I do not know if it is accurate and you are encouraged to consult an attorney if this may apply to you.) So you should beware if you are looking at a coming up short-sale or foreclosure and you have the ability to pay the debt.

Saturday, October 19, 2013

Roofs, Random Thoughts

I am going to have a new roof put on my house in the next couple of weeks.

OUCH! New roofs are expensive, that is the first thing I learned.

Building codes only allow a maximum of two layers, which my roof already has, so that makes it even more expensive. (Which was the 2nd thing I learned.)

Prices, even between reputable firms vary drastically, it can pay to shop around. (Lesson #3?)

I happened to receive an email on vent problems in a roof from Dave Thomsen Inspections, I thought I 'd include those as well.

The inspection on one of my last sales revealed possible mold in the attic due to the bathroom being vented into the attic instead of outside. The listing agent indicated she had found that on several homes built by a particular builder. YIKES

So keep a good roof over your head, ya hear!

OUCH! New roofs are expensive, that is the first thing I learned.

Building codes only allow a maximum of two layers, which my roof already has, so that makes it even more expensive. (Which was the 2nd thing I learned.)

Prices, even between reputable firms vary drastically, it can pay to shop around. (Lesson #3?)

I happened to receive an email on vent problems in a roof from Dave Thomsen Inspections, I thought I 'd include those as well.

|

The inspection on one of my last sales revealed possible mold in the attic due to the bathroom being vented into the attic instead of outside. The listing agent indicated she had found that on several homes built by a particular builder. YIKES

So keep a good roof over your head, ya hear!

Friday, October 18, 2013

Why You Should Sell Your House Now

COURTESY OF KCM BLOG

Thursday, October 17, 2013

Homeownership and Net Worth

Over the last five years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A recentstudy by the Federal Reserve formally answered this question.

Some of the findings revealed in their report:

- The average American family has a net worth of $77,300

- Of that net worth, 61.4% ($47,500) of it is in home equity

- A homeowner’s net worth is over thirty times greater than that of a renter

- The average homeowner has a net worth of $174,500 while the average net worth of a renter is $5,100

Bottom Line

The Fed study found that homeownership is still a great way for a family to build wealth in America.

Wednesday, October 16, 2013

Ada County in Pictures! (September Market Report That Is!)

Tuesday, October 15, 2013

September Housing Market Summary…are you people in Washington really going to mess this up?

|

Friday, October 4, 2013

Buyers-Window of Opportunity Still Open

Yesterday I spoke of knowing where we are "headin." Here is some additonal projections about where the mortgage rates will head. The Fed recently announced they would contiue to purchase bonds, which eased the upward pressure on mortgage rates.

The Fed recently announced they would continue their current pace of purchasing bonds until the economy was stronger. This bond purchasing program is the reason that mortgage interest rates are at historic lows. Rates began to increase over the last several months just on the anticipation that the Fed would announce that they would be reducing the level of bond purchases last month. When that didn’t happen, rates actually decreased (4.50 to 4.37).

The Fed recently announced they would continue their current pace of purchasing bonds until the economy was stronger. This bond purchasing program is the reason that mortgage interest rates are at historic lows. Rates began to increase over the last several months just on the anticipation that the Fed would announce that they would be reducing the level of bond purchases last month. When that didn’t happen, rates actually decreased (4.50 to 4.37).

That was great news for any buyer in the process of purchasing a home. However, this window of opportunity is expected to close in the very near future as most experts expect the Fed to taper the bond purchasers in December. Even Ben Bernanke, Chairman of the Fed, suggested that the Fed could still scale back the stimulus this year. He stated:

"If the data confirms our basic outlook, then we could move later this year.”

Where will mortgage rates head in 2014?

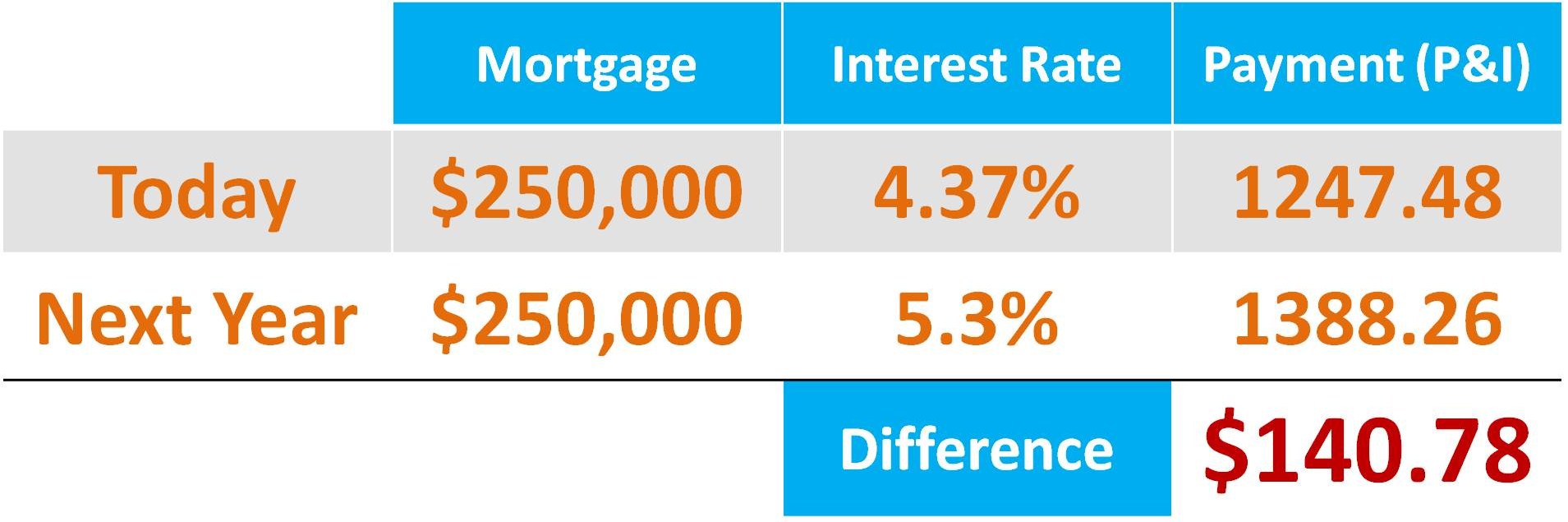

The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors have each projected that the 30 year fixed rate mortgage will have interest rates in excess of 5% by this time next year. The average of their four projections is 5.3%. The table below shows the impact this will have on the monthly principal and interest payment on a $250,000 mortgage:

A buyer should take advantage of the current window of opportunity before it is too late.

A buyer should take advantage of the current window of opportunity before it is too late.

Give me a call today, to get started finding your home before the window closes!

The Fed recently announced they would continue their current pace of purchasing bonds until the economy was stronger. This bond purchasing program is the reason that mortgage interest rates are at historic lows. Rates began to increase over the last several months just on the anticipation that the Fed would announce that they would be reducing the level of bond purchases last month. When that didn’t happen, rates actually decreased (4.50 to 4.37).

The Fed recently announced they would continue their current pace of purchasing bonds until the economy was stronger. This bond purchasing program is the reason that mortgage interest rates are at historic lows. Rates began to increase over the last several months just on the anticipation that the Fed would announce that they would be reducing the level of bond purchases last month. When that didn’t happen, rates actually decreased (4.50 to 4.37).That was great news for any buyer in the process of purchasing a home. However, this window of opportunity is expected to close in the very near future as most experts expect the Fed to taper the bond purchasers in December. Even Ben Bernanke, Chairman of the Fed, suggested that the Fed could still scale back the stimulus this year. He stated:

"If the data confirms our basic outlook, then we could move later this year.”

Where will mortgage rates head in 2014?

The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors have each projected that the 30 year fixed rate mortgage will have interest rates in excess of 5% by this time next year. The average of their four projections is 5.3%. The table below shows the impact this will have on the monthly principal and interest payment on a $250,000 mortgage:

A buyer should take advantage of the current window of opportunity before it is too late.

A buyer should take advantage of the current window of opportunity before it is too late.Give me a call today, to get started finding your home before the window closes!

Thursday, October 3, 2013

Where are we going?

This is a song from the old musical, "Paint your Wagon." The lyrics go something like this: Where am I goin?/I don't know./ Where am I headin?/I ain't certain./ All I know am I am on my way.

There is also a quote from Voltaire stating: "I don't know where I am going, but I am on my way."

We may not know where the housing market is going but we are on our way. But there are folks who predict where we are" headin." The National Association of Realtors predict the following.

There is also a quote from Voltaire stating: "I don't know where I am going, but I am on my way."

We may not know where the housing market is going but we are on our way. But there are folks who predict where we are" headin." The National Association of Realtors predict the following.

Wednesday, October 2, 2013

Subscribe to:

Comments (Atom)

![CoffeeInfographic-e1379346654723[1]](http://www.kcmblog.com/wp-content/uploads/2013/09/StarbucksInfographic-e13793466547231.jpg)