by Marc Lebowitz, RCE, CAE Executive Director Ada County Association of REALTORS Sales in September 2012 were 563 in Ada County, an decrease of 3% compared to September 2011. Year-to-date sales are 5,258; 9.13% over the first nine months of 2011.

Dollar volume for September was up 14% to $117Mil. For the year we are at $1.043Billion!

New homes sold in September increased 53% over new homes sold in September of 2011!!…and are up 63.4% YTD.

Historically, September sales decrease by 9% from August. September 2012 sales decreased by 20% from August 2012.

Of our total sales in September… 21% were distressed (112 total sales)….unchanged from August 2012. In September 2011, 42% of our sales were distressed. In January 56% of distressed properties were REOs and 44% were short sales. In September the ratio was 71% short sales (79 total sales) and 29% REOs (32 total sales). This is six consecutive months with short sales being the larger percentage of distressed properties sold.

Pending sales at the end of September were 1,110; unchanged from the end of August. In general pending sales in May are the highest of the year; and June the second highest. The percentage of pending sales in distress increased 1% from August, totaling 28% overall. There has been very little fluctuation in this number since May 2012 when we first went below 30%. A year ago we were averaging close to 50% of pendings in distress; but have decreased steadily since January. Of Pending sales in distress, short sales outnumbered REO’s 2.5 to 1.

At the end of September, we had 28% more sales pending than at the end of September 2011.

September median home price was $174,990; up 21% from September 2011. Median home price is up 27% since January of this year and above $150,000 for eight months running. We continue to outpace our national recovery; according to

NAR’s most recent report.

New Homes median price for September was $240,565; up 12.5% from September 2011.

The number of houses available decreased 1% from August; reversing a five month trend of modest increases. At the end of September our total active inventory was 2,092 homes. This is 9% less than last year at this time.

At the same time, the percentage of distressed active dropped 1% to 23%. This is the lowest number we’ve seen in several years. We have been hovering between 33% and 36% for the last year. We remain well below the 40% levels set last spring….when we were on the increase.

With an inventory increasing and the percentage of distressed inventory decreasing; median home price will continue to strengthen.

Of our Distressed Inventory 91% is Short Sales (437 homes) and only 9% is REO (43 homes); nearly unchanged from last month.

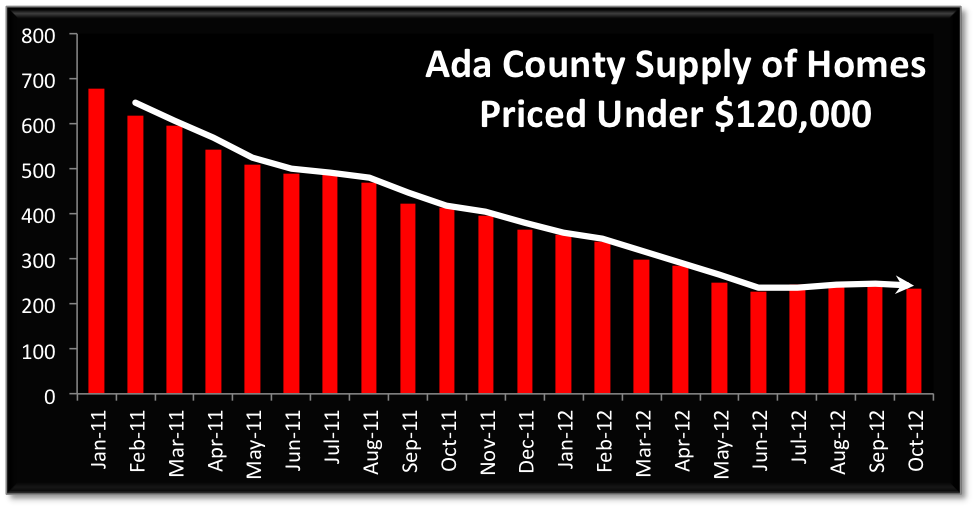

Available inventory declined in most price points. We added eight homes in the $200,000 to $250,000 and ten homes in the $400,000 to $500,000 price ranges…and…we added one home in the $700,000 to $1,000000. All other price points had decreases in available inventory.

The number of available new homes increased in the price ranges of $160,000 to $200,000 by a total of ten homes; and by seventeen homes in the $250,000 to $300,000.

In Ada County we now have less than 3.2 months of inventory on hand.

The price category in shortest supply is in the range of $120,000 to $159,999 where we have 2.3 months. All price points up to $400,000 have less than 4 month’s supply. We have benefited for nearly two years from inventory levels much lower than national average.

Multiple offers are much more prevalent; now becoming the norm.

Based on September sold data, our most desirable price point is $120,000 to $160,000 which was 23% of total sales. The next largest price point sold is $160,000 to $200,000 at 15.4% of all sales.

Yesterday, we discussed

Yesterday, we discussed  When deciding whether or not to buy a home, one consideration will be the cost of alternative housing options. Renting an apartment is one such alternative. Where are rental prices heading over the next few years?

When deciding whether or not to buy a home, one consideration will be the cost of alternative housing options. Renting an apartment is one such alternative. Where are rental prices heading over the next few years? We have been happy to report that house prices have increased over the last several months. However, we have also

We have been happy to report that house prices have increased over the last several months. However, we have also  We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain.

We have often talked about the difference between COST and PRICE. As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As a buyer, you must be concerned not about price but instead about the ‘long term cost’ of the home. Let us explain.