Friday, December 14, 2012

So just how long does a Foreclosure take?

So just how long does a Foreclosure take?In Idaho, from the time of the official Notice of Default, it must by law be a minimum of 120 Days until the trustee sale. How long from when you quit making payments do you receive a Notice of Default? That varies greatly between lenders and even within lenders. It can be 45 days to years, literally years. Most are more likely in the 90 to 120 days time frame. Today I am including a graphic that shows the national average nationally by state of foreclosure time frames.

Thursday, December 13, 2012

Homeownership as an Investment

| Homeownership as an Investment Posted: 12 Dec 2012 04:00 AM PST However, since the subject of comparing real estate to other investments has come up, let’s take a closer look. There are two major advantages to investing in a home of your own rather than another option: You Can’t Live in Your IRAWhen you buy your own home you are not taking available dollars away from another investment. You are replacing one housing expense (rent) which has no potential for a return on investment with another (mortgage payment) that does give you an opportunity for a return. We realize that there has been research showing that over the last 30 years renting has been less expensive than owning. That research also says that if you invested the entire difference between the rent payment and mortgage payment you may have done better financially. There are two challenges with this conclusion:

Today,studies show that owning a home is no more expensive than renting a home. However, even if this wasn’t the case, history shows that owning a home creates greater wealth. Paying a mortgage creates what financial experts call ‘forced savings’. The Joint Center for Housing Studies at Harvard University released a study last year titled America’s Rental Housing: Meeting Challenges, Building on Opportunities. In the study, they actually quantified the difference in family wealth between renters and homeowners: “[R]enters have only a fraction of the net wealth of owners. Near the peak of the housing bubble in 2007, the median net wealth of homeowners was $234,600—about 46 times the $5,100 median for renters. Even if homeowner wealth fell back to 1995 levels, it would still be 27.5 times the median for renters.” There Are Tremendous Tax Advantages to Investing in a HomeThere is no doubt that selling an investment such as gold is easier than selling your home. However, this liquidity comes at a price. The price is called capital gains. That is the tax you pay on any financial gain you receive from the investment. This tax doesn’t apply the same way when you sell your primary residence: Theresa Palagonia, a CPA and the Accounting Manager for the firm G.S. Garritano & Associates, was good enough to explain the Home Sale Exclusion Rules: “You may qualify to exclude from your income all or part of any gain from the sale of your main home. Bottom LineEvery investment has pros and cons. That is why there is such an assortment of great opportunities. Real Estate has been, is and always will be one of those opportunities. |

Wednesday, December 12, 2012

Was 2012 a Better Year for Real Estate Than 2011?

ABSOLUTELY! Yesterday I ran an article on our Ada County statistics. Following is a graph showing pending home sales nationally. Real estate sales continue to climb, and with interest rates around 3.5% and prices starting to increase, why not?!?

From KCM Blog

There are still those questioning whether the housing market is truly making a comeback. We have decided to graph home sales over the last two years based on the National Association of Realtor‘sPending Home Sales Report. We believe the graph removes all doubt.

The methodology for the report as per NAR:

“The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

The index is based on a large national sample, typically representing about 20 percent of transactions for existing-home sales. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months.

An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined as well as the first of five consecutive record years for existing-home sales; it coincides with a level that is historically healthy.”

From KCM Blog

There are still those questioning whether the housing market is truly making a comeback. We have decided to graph home sales over the last two years based on the National Association of Realtor‘sPending Home Sales Report. We believe the graph removes all doubt.

The methodology for the report as per NAR:

“The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

The index is based on a large national sample, typically representing about 20 percent of transactions for existing-home sales. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months.

An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined as well as the first of five consecutive record years for existing-home sales; it coincides with a level that is historically healthy.”

Tuesday, December 11, 2012

Ada County Recovery Continues!

|

Saturday, December 8, 2012

Get the Price right at the start!

I talk about this on every listing appointment I go to, it is critical to price your home right from the start. I can not count how many times I have heard: "We can always go down but we can't go up." Very true, but if you start too high you often will indeed go lower, lower than you would have if you had started more accurately. If you thinking about selling your house, call me, price it right and get a better return!

With the housing market showing signs of a recovery, sellers may think they can list their homes at a higher price and adjust if necessary. That may not be a good strategy. This is a post we ran last year by Ken H. Johnson, Ph.D. — Florida International University (FIU) and Editor of the Journal of Housing Research. To view other research from FIU, visit http://realestate.fiu.edu/. - The KCM Crew

Are there any negative effects from changing the listing price of a property? This question haunts Brokers/Agents as well as sellers of property every day. At present, there does not seem to be a consensus answer to this question within the professional real estate community. Fortunately, this question was scientifically investigated by John R. Knight. Unfortunately, few know the results of Professor Knight’s research.

In Knight, the impact of changing a property’s listing price is investigated. Additionally, the types of property that are most likely to experience a price change are also estimated. The findings from this research indicate that, on average, properties which experience a listing price change take longer to sell and suffer a price discount greater than similar properties. Furthermore, bigger price changes are found to experience even longer marketing times and greater price discounts. Finally, as for which properties are most likely to experience a price change, Knight finds that the greater the initial markup; the higher the likelihood that any given property will experience a listing price change.

Sellers as well as Brokers/Agents should therefore be aware of the critical necessity of getting the price correct from the start. Sellers wanting to over list will ultimately take longer to sell and will sell their property for less, on average, according to Knight. Brokers/Agents’ desire to take a listing and get the price right later will ultimately lead to their working harder according to Knight, and they are not doing their sellers any favors. Thus, an initial and detailed analysis of the proper price is much more critical than many originally thought.

Interestingly, I have found in my own research that the direction (up or down) of the listing price change does not matter. A listing price increase and decrease both lead to similar results found in Knight’s work – longer marketing times and lower prices. Therefore, get the price right from the beginning. It is best for all.

With the housing market showing signs of a recovery, sellers may think they can list their homes at a higher price and adjust if necessary. That may not be a good strategy. This is a post we ran last year by Ken H. Johnson, Ph.D. — Florida International University (FIU) and Editor of the Journal of Housing Research. To view other research from FIU, visit http://realestate.fiu.edu/. - The KCM Crew

The Research

The Research

Are there any negative effects from changing the listing price of a property? This question haunts Brokers/Agents as well as sellers of property every day. At present, there does not seem to be a consensus answer to this question within the professional real estate community. Fortunately, this question was scientifically investigated by John R. Knight. Unfortunately, few know the results of Professor Knight’s research.

In Knight, the impact of changing a property’s listing price is investigated. Additionally, the types of property that are most likely to experience a price change are also estimated. The findings from this research indicate that, on average, properties which experience a listing price change take longer to sell and suffer a price discount greater than similar properties. Furthermore, bigger price changes are found to experience even longer marketing times and greater price discounts. Finally, as for which properties are most likely to experience a price change, Knight finds that the greater the initial markup; the higher the likelihood that any given property will experience a listing price change.

Implications for Practice

Sellers as well as Brokers/Agents should therefore be aware of the critical necessity of getting the price correct from the start. Sellers wanting to over list will ultimately take longer to sell and will sell their property for less, on average, according to Knight. Brokers/Agents’ desire to take a listing and get the price right later will ultimately lead to their working harder according to Knight, and they are not doing their sellers any favors. Thus, an initial and detailed analysis of the proper price is much more critical than many originally thought.

Interestingly, I have found in my own research that the direction (up or down) of the listing price change does not matter. A listing price increase and decrease both lead to similar results found in Knight’s work – longer marketing times and lower prices. Therefore, get the price right from the beginning. It is best for all.

Five Reasons to BUY NOW!

Friday, December 7, 2012

October market report in pictures…things are heating up

Today is a recap of yesterday's numbers in picture form. Which do you prefer?

Thanks to Mac Lebowitz of the Ada County Association of Realtors!

Thursday, December 6, 2012

Ada County, End Of Year Sales Really Kicks In…

Yesterday I posted a combined report for Ada and Canyon counties from Pioneer Title Company. This morning is amore detailed report of Ada County.

by Marc Lebowitz, RCE, CAE

ACAR Executive Director

Sales in October 2012 were 631 in Ada County, an increase of 17% compared to October 2011. Year-to-date sales are 5,895; 10% over the first nine months of 2011.

Dollar volume for October was up 39% to $132Mil. For the year we are at $1.177Billion!

New homes sold in October increased 91% over new homes sold in September of 2011!!…and are up 67% YTD.

Historically, October sales decrease by 7% from September. October 2012 sales increased by 12% from September 2012.

Of our total sales in October… 24% were distressed (151 total sales)….up 3% from September 2012. In October 2011, 45% of our sales were distressed. In January 56% of distressed properties were REOs and 44% were short sales. In September the ratio was 71% short sales (79 total sales) and 29% REOs (32 total sales). In October something interesting happened…Short sales fell from 71% to 58% (87 total sales) of total distressed transactions while REO’s increased from 29% to 42% (64 total sales) overall. Although not a large raw number, it represents an increase of REO activity and is something to watch. This is eight consecutive months with short sales being the larger percentage of distressed properties sold.

Pending sales at the end of October were 992; down 11% from September. In general pending sales in May are the highest of the year; and June the second highest. The percentage of pending sales in distress decreased 1% from September, totaling 27% overall. There has been very little fluctuation in this number since May 2012 when we first went below 30%. A year ago we were averaging close to 50% of pendings in distress; but have decreased steadily since January. Of Pending sales in distress, short sales outnumbered REO’s 2.7 to 1.

At the end of October, we had 22% more sales pending than at the end of October 2011.

October median home price was $178,000; up 19% from October 2011. Median home price is up 29% since January of this year and above $170,000 for six months running. We continue to outpace our national recovery; according to NAR’s most recent report.

New Homes median price for October was $241,979; up 16% from October 2011.

The number of houses available at the end of October decreased 7% from September. At the end of October our total active inventory was 1,962 homes. This is 14% less than last year at this time.

At the same time, the percentage of distressed active listings increased 1% to 24%. This is the second lowest number we’ve seen in several years. We have been hovering between 33% and 36% for the last year. We remain well below the 40% levels set last spring….when we were on the increase.

With an inventory increasing and the percentage of distressed inventory decreasing; median home price will continue to strengthen.

Of our Distressed Inventory 90% is Short Sales (392 homes) and only 10% is REO (47 homes); nearly unchanged from last month.

Available inventory declined in all price points.

In Ada County we now have less than 3.3 months of inventory on hand.

The price category in shortest supply is < $159,999 where we have 2.3 months. All price points up to $400,000 have less than 4 month’s supply. We have benefited for nearly two years from inventory levels much lower than national average.

Multiple offers are much more prevalent; now becoming the norm.

Based on October sold data, our most desirable price point is $120,000 to $160,000 which was 23% of total sales. The next largest price point sold is $160,000 to $200,000 at 15.4% of all sales.

Wednesday, December 5, 2012

THE PTC INDEX FOR ADA AND CANYON COUNTIES

This index provided by Pioneer Title provides an excellent snapshot of out real estate market here in the Boise-Nampa Metro area.

The PTC Index is a monthly measurement of the vibrancy of the Treasure Valley real estate market. Based on a custom weighted algorithm, it combines nine critical measurements of the real estate market into a single, useful number: the PTC Index. To give you some perspective, when the market was at its most active point in 2005, the PTC Index average would have been 225. In January of 2010 we reached a low of 28. Though times have changed, the need for this data is greater than ever.

All I can say is WOW!

The PTC Index is a monthly measurement of the vibrancy of the Treasure Valley real estate market. Based on a custom weighted algorithm, it combines nine critical measurements of the real estate market into a single, useful number: the PTC Index. To give you some perspective, when the market was at its most active point in 2005, the PTC Index average would have been 225. In January of 2010 we reached a low of 28. Though times have changed, the need for this data is greater than ever.

Typically, the Treasure Valley real estate market shows signs of slowing down ahead of the winter months in October but this year October has been distinctive. Building permits are up 11% from the month prior, while new home sales making gains of nearly 25% during the same time period. In the year ago time frame, existing home sales are holding steady with gains of 8.1% over Sept 2012. As expected, refis are still making gains; October's refinances are up 26.5% from the month prior. The average sales price in the Treasure Valley rose a bit to $165,155, up 20.6% from a year ago. Notices of default and distressed properties ticked down from September by 3.6% and 12.1%, respectively.

October 2012

| Building Permits | 237 |

| New Home Sales | 195 |

| Existing Home Sales | 706 |

| Refinance | 2050 |

| Average Sales Price | 167550.5 |

| Financial-Bond Market(10-yr Treasury) | 1.75 |

| Days on Market | 64.5 |

| Distressed(Short Sales and REO) | 2112 |

| Notices of Default | 298 |

| PTC Index | 266 |

All I can say is WOW!

Tuesday, December 4, 2012

Will the Mortgage Forgiveness Act Be Extended?

This is a big question for anyone still facing foreclosure or considering a short sale. I hope Congress can get it together long enough to at least handle this critical issue.

The Mortgage Forgiveness Debt Relief Act of 2007 is set to expire at the end of the year. The act allows taxpayers to be excluded from paying taxes on forgiven debt in certain situations. As their website explains:

The Mortgage Forgiveness Debt Relief Act of 2007 is set to expire at the end of the year. The act allows taxpayers to be excluded from paying taxes on forgiven debt in certain situations. As their website explains:

The act also applies to debt forgiven in a short sale. The big question is whether or not Congress will extend it past the December 31st deadline. Forty-one state attorneys general signed a letter urging Congressional leaders to extend the act. In the letter, it is explained:

The push is on to get an extension. Here are the current bills in Congress:

Whether Congress will act in time to extend the act before its expiration is anyone’s guess.

“The Mortgage Debt Relief Act of 2007 generally allows taxpayers to exclude income from the discharge of debt on their principal residence. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief.”

The act also applies to debt forgiven in a short sale. The big question is whether or not Congress will extend it past the December 31st deadline. Forty-one state attorneys general signed a letter urging Congressional leaders to extend the act. In the letter, it is explained:

“Each of our offices receives calls every day from homeowners trying to save their homes or struggling to recover from losing their homes…Congress must act. We urge you to extend the existing exclusion of forgiven or cancelled mortgage debt from taxable income under federal law before it expires at the end of this calendar year.”

The push is on to get an extension. Here are the current bills in Congress:

- U.S. House of Representatives: Resolution 4336 and Resolution 4202

- Senate: Senate Bill 2250

Whether Congress will act in time to extend the act before its expiration is anyone’s guess.

Monday, November 26, 2012

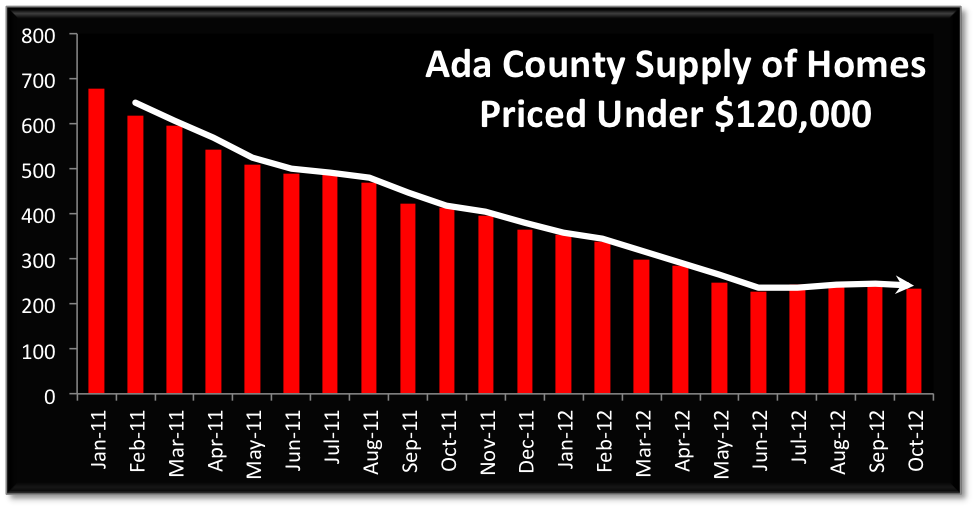

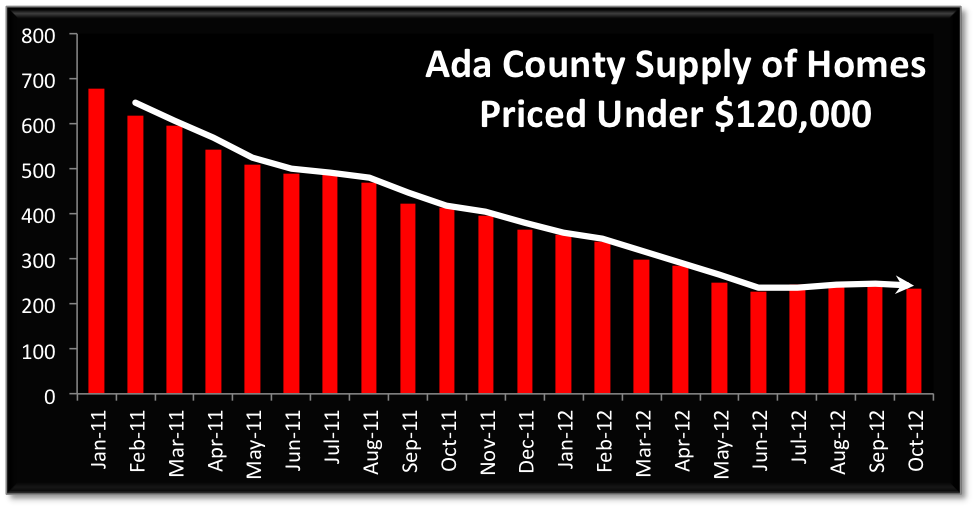

A Segment in the Boise Real Estate Market is Disappearing.

Here is a great article reprinted from Boise Agent Weekly.

Home Sales are up in all price ranges in Boise (Ada County). All prices ranges except homes priced below $120,000. The supply of homes priced under $120,000 is disappearing, which has lead to a sharp decrease in sales in this price range.

WHY THIS IS IMPORTANT:

If you are hoping to buy a home price near $100K or below, better start getting busy. Most sales in this price range today are from old short sales started months ago. As of this writing there are only 59 available homes in ADA County priced under $100K (including townhomes and condos). Exactly one year ago there were 266 homes available under $100K.

Ada County homes priced under $100K are relativity a new thing for Boise. This price range was effectively created due to the massive outpouring of foreclosures on the market. Banks often competed with each other to make sure their homes sold which caused a sharp drop in home prices and a large uptick in homes sold under $100,000.

Now that Foreclosures have slowed down, there is no longer the downward pressure on home prices and almost no inventory of homes below $100,000 available anymore, unless a new distressed property comes available.

The lack of home sales below $100,000 is Boise's biggest insurance policy protecting homeowners from further price declines in the area. For home prices to drop significantly in the Boise area again there would need to be another surge in inventory priced below $120,000. If that surge does happen it would be an early warning sign that prices will dip again. Right now the entire county is sitting at record lows for available supply. There are no active threats influencing the Boise housing market except for winter slow downs. Therefore, I am predicting home prices should stay strong into 2013 and stay way above last year's numbers.

Home Sales are up in all price ranges in Boise (Ada County). All prices ranges except homes priced below $120,000. The supply of homes priced under $120,000 is disappearing, which has lead to a sharp decrease in sales in this price range.

WHY THIS IS IMPORTANT:

If you are hoping to buy a home price near $100K or below, better start getting busy. Most sales in this price range today are from old short sales started months ago. As of this writing there are only 59 available homes in ADA County priced under $100K (including townhomes and condos). Exactly one year ago there were 266 homes available under $100K.

Ada County homes priced under $100K are relativity a new thing for Boise. This price range was effectively created due to the massive outpouring of foreclosures on the market. Banks often competed with each other to make sure their homes sold which caused a sharp drop in home prices and a large uptick in homes sold under $100,000.

Now that Foreclosures have slowed down, there is no longer the downward pressure on home prices and almost no inventory of homes below $100,000 available anymore, unless a new distressed property comes available.

The lack of home sales below $100,000 is Boise's biggest insurance policy protecting homeowners from further price declines in the area. For home prices to drop significantly in the Boise area again there would need to be another surge in inventory priced below $120,000. If that surge does happen it would be an early warning sign that prices will dip again. Right now the entire county is sitting at record lows for available supply. There are no active threats influencing the Boise housing market except for winter slow downs. Therefore, I am predicting home prices should stay strong into 2013 and stay way above last year's numbers.

Saturday, November 24, 2012

Foreclosures-Discounts or not?

I have noticed in the Ada County market, and somewhat in Canyon county as well that foreclosure sales are not always reflecting the discounted prices from regular sales that has been the norm. This is due to our low inventory levels. This illustrates that buyers need to check values on homes individually not just assume that foreclosures or short sales are ALWAYS the best deals. I help buyers find the best values in all types of sales.

I am also reprinting a article speaking of this issue nationally.

Foreclosure discounts have nearly dried up due to low inventory levels, according to the latest housing reports.

The average discount nationwide for foreclosure properties has fallen to 7.7 percent, according to Zillow research. In some parts of the country, there is no foreclosure discount when compared to other sales.

“The smallest foreclosure discount is found in places where competition for homes is so high, people there are willing to pay the same amount for a foreclosure re-sale that they would for a non-distressed home simply to take advantage of historic affordability,” says Stan Humphries, Zillow’s chief economist.

The smallest foreclosure discounts can be found in:

Meanwhile, the places with the largest foreclosure discounts are:

Source: “Low Inventory Wipes Out Foreclosure Discount,” Examiner.com (Nov. 18, 2012)

I am also reprinting a article speaking of this issue nationally.

Foreclosure Discounts Vanishing

Foreclosure discounts have nearly dried up due to low inventory levels, according to the latest housing reports.

The average discount nationwide for foreclosure properties has fallen to 7.7 percent, according to Zillow research. In some parts of the country, there is no foreclosure discount when compared to other sales.

“The smallest foreclosure discount is found in places where competition for homes is so high, people there are willing to pay the same amount for a foreclosure re-sale that they would for a non-distressed home simply to take advantage of historic affordability,” says Stan Humphries, Zillow’s chief economist.

The smallest foreclosure discounts can be found in:

- Las Vegas (0%)

- Phoenix (0%)

- Sacramento, Calif. (0.7%)

- Riverside, Calif. (1.8%)

- San Diego (2.4%)

- Miami-Ft. Lauderdale (2.9%)

- Los Angeles (4.2%)

- San Francisco (4.7%)

Meanwhile, the places with the largest foreclosure discounts are:

- Pittsburgh, Pa. (27.8%)

- Cleveland (25.8%)

- Cincinnati (20.2%)

- Baltimore (20%)

- New York City (15.5%)

Source: “Low Inventory Wipes Out Foreclosure Discount,” Examiner.com (Nov. 18, 2012)

Friday, November 23, 2012

Is It Time to Buy A Rental Property?

With house prices inching up and rents skyrocketing, this may be the perfect time to invest in single family residential real estate.

If you do, you won’t be alone. According to the National Association of Realtors’ (NAR) 2012 3rd Quarter Metro Area Report:

“Investors…accounted for 17 percent of all transactions in the third quarter.”

More than one out of every six houses sold are purchased by an investor. In the most recent MarketPulse Report by CoreLogic, their Principal Economist, Sam Khater, wrote on the subject in a story titled Roll Tide, or The Rise of the Single Family Rental Market. The major takeaways from the article are:

- The single-family rental market remained very active in the late summer of 2012 with increases in demand, tightening inventory and rising rents.

- Nationally, rental leasing volumes were up every month for two years. In August, they were up 7% over last year.

- Supply was down 11% over the same period.

- This tightness in supply has caused rents to increase.

- Rent growth is expected to increase at a ‘strong clip’ late in 2012 and in 2013.

If a private investor is looking for a great hands-on opportunity, perhaps purchasing a single-family house to rent out makes sense.

Give me a call to check out the opportunities today! 280-386-2992

Thursday, November 22, 2012

Where Are Rents Headed?

Here in the Boise Valley we have seen rents increase. A couple of things to think about: if you are renting it may be an excellent time to buy, and if you have ever thought about having rental income, there are still some excellent deals out there!

When deciding whether or not to buy a home, one consideration will be the cost of alternative housing options. Renting an apartment is one such alternative. Where are rental prices heading over the next few years?

When deciding whether or not to buy a home, one consideration will be the cost of alternative housing options. Renting an apartment is one such alternative. Where are rental prices heading over the next few years?

Rental prices usually increase by about 3 percent annually. Trulia just released their Trulia Rent Monitor where they revealed that rental prices have increased dramatically in the last year.

Based on the concept of supply and demand, we believe rental prices will continue to substantially increase over the next few years. The long-run 30-year average increase in rental households is 200,000 each year. Over the next few years, those numbers will more than double to over 500,000 each year. Freddie Mac in their latest report, Multifamily Research Perspectives, projects housing demand going forward.

The cost of owning a home will begin to increase as both prices and mortgage rates are expected to inch up in 2013. Perhaps now is the perfect time to lock in your long term housing expense by purchasing your own home.

Rental prices usually increase by about 3 percent annually. Trulia just released their Trulia Rent Monitor where they revealed that rental prices have increased dramatically in the last year.

“Nationally, rent gains continued to outpace home price increases in October, rising by 5.1 percent.”

Based on the concept of supply and demand, we believe rental prices will continue to substantially increase over the next few years. The long-run 30-year average increase in rental households is 200,000 each year. Over the next few years, those numbers will more than double to over 500,000 each year. Freddie Mac in their latest report, Multifamily Research Perspectives, projects housing demand going forward.

“Given assumptions consistent with economic growth slightly slower than long run averages, multifamily demand is likely to be in the range of 1.7 million net new renter households between now and 2015.”

The cost of owning a home will begin to increase as both prices and mortgage rates are expected to inch up in 2013. Perhaps now is the perfect time to lock in your long term housing expense by purchasing your own home.

Wednesday, November 21, 2012

Why Waiting Until Spring to Sell May NOT Make Sense

CoreLogic, in their latest House Price Index revealed that prices increased by 5% over last year. Yet, prices actually dropped .3% month-over-month (m-o-m). Analytics firm FNC, in their latestResidential Price Index, reported that prices increased 2.3% over the last year but prices remained unchanged m-o-m.

What Does This Mean for Sellers?

Sellers should be excited about the headlines showing price appreciation across the country for the first time in a long time. However, if you want to sell your home in the next 6-8 months realize that there is a better chance that prices will soften than appreciate during that time span. Waiting until the spring for a better price probably makes little sense.

Tuesday, November 20, 2012

Cost vs. Price Explained

Yesterday, we reported that the Mortgage Bankers Association (MBA) is projecting that mortgage interest rates will inch up over the next twelve months. On Monday, we explained that many experts are calling for home prices to also increase over the next year. What Does This Mean to a Buyer?Here is a simple demonstration of what impact certain changes would have on the mortgage payment of a home selling for approximately $200,000 today: |

Monday, November 19, 2012

Cycle of Foreclosure, About to be Broken?

|

Friday, October 26, 2012

Appraisals: Friend or Foe?

Whenever you have a lender involved in the purchase of a property an appraisal is required. There are more stringent requirements on appraisers these days, many of which I believe are justified.

Did you know that the appraiser will have a copy of your purchase and sale contract? They will. And frankly they will try to hit the agreed upon price if they can justify it. To keep both sellers and buyers satisfied that is the best result. But today we do see more issues arise than we did in the past. One of the areas that can be difficult is we have seen appreciating values this year in Ada and Canyon counties, contributed to by out low inventory levels, multiple bids and low interest rates. It can be difficult to find accurate comps for your listing.

In a recent survey conducted by the National Association of Realtors (NAR), it was revealed that:

I personally have not had any major issues thus far, but I work hard to establish accurate values for both my sellers and the buyer I represent. I am also including an interesting graphic from KCM Blog.

Did you know that the appraiser will have a copy of your purchase and sale contract? They will. And frankly they will try to hit the agreed upon price if they can justify it. To keep both sellers and buyers satisfied that is the best result. But today we do see more issues arise than we did in the past. One of the areas that can be difficult is we have seen appreciating values this year in Ada and Canyon counties, contributed to by out low inventory levels, multiple bids and low interest rates. It can be difficult to find accurate comps for your listing.

In a recent survey conducted by the National Association of Realtors (NAR), it was revealed that:

- 11% of Realtors said a contract was cancelled because an appraised value came in below the price negotiated between the buyer and seller

- 9% reported a contract was delayed

- 15% said a contract was renegotiated to a lower sales price as a result of a low valuation

I personally have not had any major issues thus far, but I work hard to establish accurate values for both my sellers and the buyer I represent. I am also including an interesting graphic from KCM Blog.

Thursday, October 25, 2012

Housing: The reasons it is coming back

Here is a good treatment on the housing market and the upward pressure on values.

Monday, we told you that many experts are beginning to call a bottom in house prices. Why? Writing in the Financial Times, Roger Altman, former deputy Treasury secretary, explained why he is so bullish on housing:

Monday, we told you that many experts are beginning to call a bottom in house prices. Why? Writing in the Financial Times, Roger Altman, former deputy Treasury secretary, explained why he is so bullish on housing:

Altman gave his thoughts on each point:

“The S&P/Case-Shiller Composite 20 City Home Price index has risen 8 per cent since March. Indeed, Barclays has projected that, by 2015, nominal home prices will exceed their 2006 peak. Home affordability is also way up, as the ratio of mortgage payments to both income and rents has never been more favourable. Moreover, the relationship of home prices to household income is back to the level of 30 years ago. Rising prices and affordability, of course, lead directly to the buying and building of homes.”

“The levels of relevant supply have fallen sharply. The number of homes for sale has fallen back to its long-term average of 2m. Yes, there is a larger “shadow inventory” of homes that are in foreclosure or carry delinquent or defaulted mortgages. However, many of these are distressed, in that they have not been physically maintained. This means that the supply has become two-tiered – quality homes and distressed homes. For most buyers, only the first of these two markets is relevant and the supply there is approaching its lowest level since 1992.”

“Housing demand is going to be strong, driven by demographics. The International Monetary Fund forecasts that the US population will increase by 15m during the 2012-17 period, more than the increase of the past five years. The two groups of the population that are growing fastest are the over-55s and the so-called echo boomers, the grandchildren of the baby-boom generation. The first group has the highest rate of home ownership. The second has been renting disproportionately, and is primed to start buying. JPMorgan estimates that 6m new units of housing are needed by 2017 just to serve the bigger population.

“There is the coming recovery in household formation. According to JPMorgan, this rate was steady at about 1.4m annually from 1958 up to 2007. But, it plunged below 500,000 for the three years following the financial crisis, as young people moved in together or lived with parents. Now it has doubled from that level and estimates of pent-up households are at an all-time high. Most expect formation rates to rise much further still, exceeding the 50-year average for a few years.”

“The availability of mortgage credit is starting to improve. Underwriting standards tightened sharply following 2008 and the proportion of home sales that are financed by new mortgages is now at a 10-year low. However, household finances have improved sharply, with debt service ratios returning to pre-crisis levels. Moreover, banks also need the income from originating mortgages. Mortgage credit availability is therefore opening up, which also boosts home sales.”

It seems apparent that many aspects of the housing market are in the process of turning much more positive.

“This surge will be driven by a combination of improving house prices, a lower inventory of homes for sale, rising rates of household formation and population growth, and improving access to mortgage credit.”

Altman gave his thoughts on each point:

PRICES

“The S&P/Case-Shiller Composite 20 City Home Price index has risen 8 per cent since March. Indeed, Barclays has projected that, by 2015, nominal home prices will exceed their 2006 peak. Home affordability is also way up, as the ratio of mortgage payments to both income and rents has never been more favourable. Moreover, the relationship of home prices to household income is back to the level of 30 years ago. Rising prices and affordability, of course, lead directly to the buying and building of homes.”

HOUSING INVENTORY

“The levels of relevant supply have fallen sharply. The number of homes for sale has fallen back to its long-term average of 2m. Yes, there is a larger “shadow inventory” of homes that are in foreclosure or carry delinquent or defaulted mortgages. However, many of these are distressed, in that they have not been physically maintained. This means that the supply has become two-tiered – quality homes and distressed homes. For most buyers, only the first of these two markets is relevant and the supply there is approaching its lowest level since 1992.”

POPULATION GROWTH

“Housing demand is going to be strong, driven by demographics. The International Monetary Fund forecasts that the US population will increase by 15m during the 2012-17 period, more than the increase of the past five years. The two groups of the population that are growing fastest are the over-55s and the so-called echo boomers, the grandchildren of the baby-boom generation. The first group has the highest rate of home ownership. The second has been renting disproportionately, and is primed to start buying. JPMorgan estimates that 6m new units of housing are needed by 2017 just to serve the bigger population.

HOUSEHOLD FORMATIONS

“There is the coming recovery in household formation. According to JPMorgan, this rate was steady at about 1.4m annually from 1958 up to 2007. But, it plunged below 500,000 for the three years following the financial crisis, as young people moved in together or lived with parents. Now it has doubled from that level and estimates of pent-up households are at an all-time high. Most expect formation rates to rise much further still, exceeding the 50-year average for a few years.”

IMPROVING ACCESS to MORTGAGE CREDIT

“The availability of mortgage credit is starting to improve. Underwriting standards tightened sharply following 2008 and the proportion of home sales that are financed by new mortgages is now at a 10-year low. However, household finances have improved sharply, with debt service ratios returning to pre-crisis levels. Moreover, banks also need the income from originating mortgages. Mortgage credit availability is therefore opening up, which also boosts home sales.”

It seems apparent that many aspects of the housing market are in the process of turning much more positive.

Wednesday, October 17, 2012

Tuesday, October 16, 2012

Ada County Real Estate September Report

|

Thursday, October 11, 2012

Boise Skyline Condo

I have a new listing, a stunning two story condo in the Veltex Building in downtown Boise. Few residences in Boise match this for location and amenities.

This penthouse unit features spectacular South and Southwest views.

Modern design and attention to detail.

Listed at $1,275,000 If you would like to view just give me a call! 208-602-0055

This penthouse unit features spectacular South and Southwest views.

Modern design and attention to detail.

Listed at $1,275,000 If you would like to view just give me a call! 208-602-0055

Wednesday, October 10, 2012

Is the California Exodus Restarting?

I received correspondance from a young family today thinking about transferring here to buy a house instead of continuiing to try and locate a house in California they can afford.

Next week I have a family coming to purchase a home after selling there home in California and due to the huge value difference they are planning on paying cash here for a similar home that they sold there.

Both of these buyers will be transferring within the same companies for employment.

So it made me wonder, if the influx is returning. It has in the past been quite pronounced, and then it had seemed to die down along with most areas of our market, but based on my experience it appears to be back on the upswing.

Next week I have a family coming to purchase a home after selling there home in California and due to the huge value difference they are planning on paying cash here for a similar home that they sold there.

Both of these buyers will be transferring within the same companies for employment.

So it made me wonder, if the influx is returning. It has in the past been quite pronounced, and then it had seemed to die down along with most areas of our market, but based on my experience it appears to be back on the upswing.

Saturday, October 6, 2012

Friday, October 5, 2012

Impact of Interest Rates on Cost of Your Idaho Home

I touched on interest rates in yesterday's post, here is a graphic that illustrates it very well.

Thursday, October 4, 2012

Idaho Home Prices Are Going UP!

Corelogic is reporting that home prices rose more in August than any time since July of 2006.

Home prices increased 4.6 percent year-over-year in August. This marks the sixth consecutive increase in home prices on month-over-month and year-over-year bases too, CoreLogic reports.

That is, of course a national figure, but IDAHO was one of the five highest appreciating states in the country.

So what does that tell you? The time to buy is now, home prices are going up and interest rates are at historic lows. My last buyer is getting 3.5% on a 30 year fixed rate. AMAZING!

Call me today to help you find your new home!

Home prices increased 4.6 percent year-over-year in August. This marks the sixth consecutive increase in home prices on month-over-month and year-over-year bases too, CoreLogic reports.

That is, of course a national figure, but IDAHO was one of the five highest appreciating states in the country.

So what does that tell you? The time to buy is now, home prices are going up and interest rates are at historic lows. My last buyer is getting 3.5% on a 30 year fixed rate. AMAZING!

Call me today to help you find your new home!

Wednesday, October 3, 2012

If Need to Short Sale, DO IT NOW!

I have spoken about this before and so far the Mortgage Forgiveness Act has not been extended. Will it? Most people believe it will, one Hill-watcher only puts the odds at 60-40, but if it is not, it will have major negative consequences for those folks short selling their homes. (As well as going through foreclosure!)

Now I am not an accountant or an attorney, and if you are facing these events I encourage you to seek the advice of competent professionals.

But my understanding is this, if you borrow money from a commercial lender and the lender later cancels or forgives the debt you may have to include that cancelled amount as income for tax purposes. You will receive a from the lender, and it will be reported to the IRS, the amount forgiven on a Form 1099-C, Cancellation of Debt.

The Mortgage Forgiveness Debt Relief Act allowed that amount to often be excluded from income on certain cancelled debt on your personal residence. It will expire the end of this year unless there is congressional action to extend.

So if you need to do it and have been putting it off, call me TODAY, time is nearly gone. 602-0055

Now I am not an accountant or an attorney, and if you are facing these events I encourage you to seek the advice of competent professionals.

But my understanding is this, if you borrow money from a commercial lender and the lender later cancels or forgives the debt you may have to include that cancelled amount as income for tax purposes. You will receive a from the lender, and it will be reported to the IRS, the amount forgiven on a Form 1099-C, Cancellation of Debt.

The Mortgage Forgiveness Debt Relief Act allowed that amount to often be excluded from income on certain cancelled debt on your personal residence. It will expire the end of this year unless there is congressional action to extend.

So if you need to do it and have been putting it off, call me TODAY, time is nearly gone. 602-0055

Wednesday, September 26, 2012

Boise, Great Place to Raise a Family!

Did you see the latest ranking from Forbes magazine? Boise was ranked 2nd best city in the country to raise a family. (Of the 100 largest metro areas)

The lower costs and less crime was mentioned along with BSU's Broncos!

If you are curious, we are just behind Grand Rapids, Michigan and ahead of Provo, UT.

The lower costs and less crime was mentioned along with BSU's Broncos!

We are listed 64th in cost of living, 44th in housing affordability, 29th in owning homes, 5th in level of crime and #1 in education.

If you are curious, we are just behind Grand Rapids, Michigan and ahead of Provo, UT.

Tuesday, September 25, 2012

Idaho Sellers-Reasons to Sell Now

I have had people asking me about whether to sell now or try and wait until spring, which traditionally is the best time to sell. No one solution fits everyone but here are some reasons to consider selling now.

We have a large amount of serious buyers still looking to buy, I have had 5 offers on 5 different properties across my desk in the last 3 days. More serious buyers are looking whereas the looky-loos have moved on to other things.

Our inventory levels are way down, it is easier to attract attention.

There will never be a better time to move up, sure you can wait until you can receive more for your home but then the home you would like to purchase will have increased in price as well. And with these unbelievably low interest rates, strike while you can.

And it may just be the time to move on with your life. Whatever is the reason you have to want to sell, it is often worth more for your family, health or happiness than waiting around for a higher selling price.

We have a large amount of serious buyers still looking to buy, I have had 5 offers on 5 different properties across my desk in the last 3 days. More serious buyers are looking whereas the looky-loos have moved on to other things.

Our inventory levels are way down, it is easier to attract attention.

There will never be a better time to move up, sure you can wait until you can receive more for your home but then the home you would like to purchase will have increased in price as well. And with these unbelievably low interest rates, strike while you can.

And it may just be the time to move on with your life. Whatever is the reason you have to want to sell, it is often worth more for your family, health or happiness than waiting around for a higher selling price.

Friday, September 21, 2012

5 Reasons to Buy NOW

Supply Is Shrinking

With inventory declining in many regions, finding a home of your dreams may become more difficult going forward. There are buyers in more and more markets surprised that there is no longer a large assortment of houses to choose from. The best homes in the best locations sell first. Don’t miss the opportunity to get that ‘once-in-a-lifetime’ buy.

Price Increases Are on the Horizon

Prices will bounce along the bottom this winter. However, projections call for appreciation after that. Several studies and surveys call for price increases over the next few years starting in 2013. One such surveyshows that prices will increase over 10% by 2016.

Rents Are Skyrocketing

Rents historically increase by 3.2% on an annual basis. A study issued earlier this year projects rent increases of 4% for the next two years. Trulia recently reported that rents this year have actually shot up by 5.4%.

Interest Rates Are at Historic Lows

Federal Reserve Chairman Ben Bernanke has kept interest rates low in an effort to stimulate a lethargic economy. He understands that low rates will help housing and housing is a key to bringing back the economy. As the economy approves, the need to keep rates low will no longer exist. The 30-year-mortgage rate before the financial crisis was 6.57% (August 2007).

Buy Low, Sell High

We would all agree that, when investing, we want to buy at the lowest price possible and hope to sell at the highest price. Housing can create family wealth as long as we follow this simple principle. Today, real estate is selling ‘low’. It’s time to buy.

Thursday, September 20, 2012

Strategic Defaults? Right or Wrong?

I have discussed this issue previously and here is another look.

“A deliberate default by a borrower. As the name implies, a strategic default is done as a financial strategy and not involuntarily. Strategic defaults are commonly employed by mortgage holders of residential and commercial property who have analyzed the costs and benefits of defaulting rather than continuing to make payments and found it more beneficial to default.” A new foreclosure is created every time a seller voluntarily decides to stop making their mortgage payment. Obviously, an increase in foreclosures puts downward pressure on the values of other homes in the community. We believe there are several reasons this could be another headwind to any recovery in housing. There Are 11.4 Million Homes in Negative EquityAccording to CoreLogic’s most recent Negative Equity Report, there are over 11.4 million homes where the value of the home is less than the value of the mortgage(s) on that home, a situation know as negative equity or being ‘underwater’. Negative Equity Is the Primary Reason Baby Boomers DefaultAccording to a survey by web site You Walk Away, 68% of baby boomers who walked away from their homes (strategic default) listed ‘property value’ as the main reason. 88% of the defaulters did not access any of their retirement savings before walking away and 97% would advise family members in the same predicament to also default. The Moral Objection to Not Default is DiminishingIn the past, homeowners felt a moral obligation to repay their debts. That is beginning to change. Dr. Andrew Jennings, chief analytics officer at FICO explains: “After five years of a brutal housing market, many people now view their homes more objectively and with less sentimentality. Regardless of legal or ethical issues around strategic defaults, lenders must account for this risk when they evaluate mortgage applications in declining markets. Many homeowners who find themselves upside down on mortgages in the future are likely to consider strategic default as an acceptable exit strategy.” Prices Could Soften Again Over the Next 6 MonthsAs we reported Monday, many experts feel that prices might falter again before they finally stabilize in 2013. Every time prices fall more homes fall deeper into negative equity. The CoreLogic report mentioned above also states that 2.3 million homes had less than 5 percent equity, referred to as near-negative equity. We will continue to keep our fingers on the pulse of this issue to monitor whether or not it begins to slow the momentum the housing recovery is currently experiencing. |

Wednesday, September 19, 2012

Smootville-What a Hoot!

I was driving out on Locust road south of Lake Lowell looking at a new acre lot subdivision for a client and I came across this animated display called Smootville. It is really quite clever from the dogs tail wagging, one person pumping water and another hoeing the flowers. I do not know if this is a seasonal display or year around but it is worth a look.

Wednesday, September 12, 2012

Will Our Appreciation Stop? Or Reverse?

I am including an article from KCM blog quoting experts stating that we may see some declines nationally in values in the coming few months as seasonal adjustments. If you read yesterday's article Mr Lebowitz's prediction for Ada County for the rest of the year was single digit sales increase and double digit median price increase. I do not believe we will see any negative price movement in our area. It may slow, but I do not see declines in our near future.

An important item covered in this report that even if some declines are experienced, it is simply a seasonal issue and not a greater "sign of impending doom."

There has been a lot of excitement about home prices over the last few months. Though we agree that the housing industry is in a full out recovery, we also believe that there will still be price volatility over the next several months. We must realize home sales are seasonal and that fact impacts prices.

There has been a lot of excitement about home prices over the last few months. Though we agree that the housing industry is in a full out recovery, we also believe that there will still be price volatility over the next several months. We must realize home sales are seasonal and that fact impacts prices.

Lawrence Yun, Chief Economist for National Association of Realtors, explains that the inventory of lower priced homes has been constrained leading to the rise in median home prices:

Celia Chen, housing analyst at Moody’s Analytics projects that this positive price movement may not be sustained over the next few months as more distressed properties enter the market:

The RPX Report suggests that price declines in the next few months could erase any gains we have seen this year:

Calculated Risk probably did the best job of explaining the situation reporting:

Again, Calculated Risk explains that this “will not be a sign of impending doom”. It is instead the normal seasonality we have seen in home prices over the last several years.

An important item covered in this report that even if some declines are experienced, it is simply a seasonal issue and not a greater "sign of impending doom."

Lawrence Yun, Chief Economist for National Association of Realtors, explains that the inventory of lower priced homes has been constrained leading to the rise in median home prices:

“Fewer sales in the lower price ranges are contributing to stronger increases in the median price, but all of the home price measures now are showing positive movement and that is building confidence in the market.”

Celia Chen, housing analyst at Moody’s Analytics projects that this positive price movement may not be sustained over the next few months as more distressed properties enter the market:

“Housing is about to turn from being a drag on the broader economy to being a driver…House prices will remain the laggard, perhaps dipping a little before hitting a sustained and solid pace of appreciation next year…The distress pipeline casts a shadow over the outlook. Indeed, the CoreLogic price index gained strongly between late 2009 and the second quarter of 2010, when foreclosure moratoriums were in place, before losing nearly all of the gains once the distress share of sales picked up again.”

The RPX Report suggests that price declines in the next few months could erase any gains we have seen this year:

“The gains of the first half of 2012 could be short lived. They were the result of seasonal factors and REO disposition strategies that could reverse in the fall. The unusually rapid price appreciation could give way to equally rapid declines in the second half of the year.”

Calculated Risk probably did the best job of explaining the situation reporting:

“Home price indexes will show month-to-month declines later this year. This should come as no surprise and will not be a sign of impending doom… There is a clear seasonal pattern. In recent years the seasonal pattern has been exaggerated by the large number of foreclosures – foreclosures tend to be fairly steady all year, but conventional sales are stronger in the spring and early summer and weaker in the fall and winter. This leads to more downward pressure from foreclosures in the fall and winter.”

Again, Calculated Risk explains that this “will not be a sign of impending doom”. It is instead the normal seasonality we have seen in home prices over the last several years.

Tuesday, September 11, 2012

Ada County Real Estate Continues Recovery

|

Monday, September 10, 2012

Saturday, September 8, 2012

Short Sales vs Foreclosures

A timely post from KCM Blog

For months now, we have been letting everyone know that banks were going to begin shifting their focus when liquidating distressed properties. They would start supporting short sales over foreclosures. There is no longer any doubt this is now the new normal.

For months now, we have been letting everyone know that banks were going to begin shifting their focus when liquidating distressed properties. They would start supporting short sales over foreclosures. There is no longer any doubt this is now the new normal.

In a recent news release, the FHFA announced new guidelines to streamline the short sale process.

You can see the new guidelines here.

In a DSNews article, both Fannie Mae and Freddie Mac reaffirmed their desire to proceed with short sales rather than foreclosures.

In a recent news release, the FHFA announced new guidelines to streamline the short sale process.

FHFA Acting Director Edward J. DeMarco on the new guidelines:

“These new guidelines demonstrate FHFA’s and Fannie Mae’s and Freddie Mac’s commitment to enhancing and streamlining processes to avoid foreclosure and stabilize communities.”

You can see the new guidelines here.

In a DSNews article, both Fannie Mae and Freddie Mac reaffirmed their desire to proceed with short sales rather than foreclosures.

Leslie Peeler, SVP, National Servicing Organization, Fannie Mae:

“Short sales have become an increasingly important tool in preventing foreclosures and stabilizing communities. We want to help as many homeowners avoid foreclosure as possible. It is vital that servicers, junior lien holders and mortgage insurers step up to the plate with us.”

Tracy Mooney, SVP Single-Family Servicing & REO at Freddie Mac:

“These changes will make it clear that Freddie Mac servicers have the authority to approve short sales for more borrowers facing the most frequently seen hardships. These changes will further empower the industry to minimize foreclosures and help Freddie Mac in its mission to minimize credit losses and fortify a national housing recovery.”

Friday, September 7, 2012

Pending Sales Trend UP!

“While the month-to-month movement has been uneven, more importantly we now have 15 consecutive months of year-over-year gains in contract activity.”

This preceded NAR’s Existing Home Sales Report which showed closed sales were up 10.4% over last year. Prices were also up 9.4% year over year. NAR expects existing home sales to rise 8 to 9 percent in 2012, followed by another 7 to 8 percent gain in 2013. Home prices are expected to increase 10 percent cumulatively over the next two years.

And even though new construction sales showed a 25% increase over last year, Yun explained that should not dramatically impact prices:

“Falling visible and shadow inventories point toward continuing price gains. Expected gains in housing starts of 25 to 30 percent this year, and nearly 50 percent in 2013, are insufficient to meet the growing housing demand.”

Housing is in the middle of a recovery without a doubt.

Thursday, September 6, 2012

Buyer Pet Peeves When Touring Homes

I just noticed this article and it makes good points in my mind as I have experienced each of them when showing buyer's homes.

What makes home buyers grimace when they tour a home for-sale? Don’t let one of your listings fall prey to one of these common buyer pet peeves. A recent article at Zillow highlights some of the following turn-offs:

3 Buyer Pet Peeves When Touring Homes

DAILY REAL ESTATE NEWS | TUESDAY, SEPTEMBER 04, 2012

What makes home buyers grimace when they tour a home for-sale? Don’t let one of your listings fall prey to one of these common buyer pet peeves. A recent article at Zillow highlights some of the following turn-offs:

- Pets: Dirty kitty litter boxes or dog toys scattered in a room can turn off buyers who associate pets with unsanitary homes. Remove all traces of pets in a home and pay attention to the home’s smell; get rid of any lingering pet odors when homes are for sale.

- Kid items: Don’t let the kids overtake a home with toys cluttering every square inch. Also, pay attention to any sanitary or personal items involving infants. For example, “leaving breast milk, a breast pump, or dirty baby bottles on the kitchen counter could make a buyer feel that the home isn’t clean or sanitary,” according to the Zillow article.

- Personal items: Watch the cleanliness of the bathroom and what’s left out: For example, make sure toothpaste residue isn’t left in the sink or prescription medications are left out in the open. “Buyers want to feel clean in the bathroom ... they don’t need to be reminded that they will be taking over a ‘used’ bathroom,” according to the Zillow article.

Wednesday, September 5, 2012

Movers Holding Owner's Hostage

Movers Hold Home Owners’ Items Hostage?

DAILY REAL ESTATE NEWS | TUESDAY, SEPTEMBER 04, 2012

Federal lawmakers are cracking down on moving companies who try to hold home owners’ belongings hostage during a move — a scam that's more common than many realize.

Home owners will soon have more protection against this increasingly reported rip-off in the moving industry. It usually involves a moving company providing a home owner with a lowball quote for a move. The mover then packs up the home owner’s belongings onto a truck and refuses to unload it until a higher fee is paid.

"If you hire a mover to transport your goods across state lines and they hold your personal property hostage, you can appeal to the Department of Transportation and it now has the power to enforce fines," Ada Vassilovski, vice president of online marketing and product management for Imagitas, told the Pittsburgh Post-Gazette.

Starting in October, movers who hold home owners’ items hostage can be fined by up to $10,000 a day, according to new rules imposed by the Federal Motor Carrier Safety Administration, an agency of the Department of Transportation. Starting in October 2014, moving company owners will be mandated to pass tests on consumer protection and moving-cost estimates, The Pittsburgh Post-Gazette reports.

"We are finally seeing recognition that movers holding people's possessions hostage is a problem," Vassilovski says. "I don't think many people are aware of this being a problem, so it's great this legislation is shining a light on it."

Tuesday, September 4, 2012

Looking on Craigslist-BEWARE

I have received calls from a couple of different folks on two different homes, one in Boise and the other in Rexburg, that I have listed. And they found these homes for rent on Craigslist for super cheap and, of course, the person renting the home is out of the country and will need money sent to them. Neither house was for rent and it was a complete scam.

I am posting an article that tells more about this common scam.

With a burgeoning "sharing economy" and the growing amount of trust in peer-to-peer marketplaces like Craigslist, consumers have become increasingly comfortable with online transactions. These days, it's no exaggeration to say that people are willing to look for almost anything online. Whether it's finding a roommate, avacation home, a life partner or a rental apartment, this "Craigslist culture" offers no-cost or low-cost services that are quick and, most importantly, convenient.

With a burgeoning "sharing economy" and the growing amount of trust in peer-to-peer marketplaces like Craigslist, consumers have become increasingly comfortable with online transactions. These days, it's no exaggeration to say that people are willing to look for almost anything online. Whether it's finding a roommate, avacation home, a life partner or a rental apartment, this "Craigslist culture" offers no-cost or low-cost services that are quick and, most importantly, convenient.

But experts warn that convenience can sometimes come at an unexpectedly high price, particularly for those who turn to free classified sites like Craigslist for real estate-related transactions. Despite the media spotlight on the dangers of Craigslist in recent years, it appears that online rental scammers are still out in full force, preying on unsuspecting renters and landlords alike.

Just this January, a couple from Lynchburg, Va., were scammed out of $1,000 and confronted by the police because of a fake rental listing they'd responded to on Craigslist.

Richard and Faith Shive (pictured left) thought they'd found a beautiful vacant home and planned to rent it from the listing's author. The landlord claimed in the ad that he was away on a humanitarian "mission," and needed to rent the property in the interim. Convinced the story was true, the Shives wired a requested $1,000 fee to the renter, received the keys, and then moved into the empty house.

Richard and Faith Shive (pictured left) thought they'd found a beautiful vacant home and planned to rent it from the listing's author. The landlord claimed in the ad that he was away on a humanitarian "mission," and needed to rent the property in the interim. Convinced the story was true, the Shives wired a requested $1,000 fee to the renter, received the keys, and then moved into the empty house.

Two days later, police officers showed up at the Shives' "new home," demanding that they leave. It turns out that, while the home was legitimately listed for rent on the market, the unscrupulous party that advertised the rental on Craigslist was not the rightful landlord. The police informed the couple that the scammer had broken into the home and posed as the rightful owner only to make off with their deposit.

"They just made it sound believable," Faith told CBN News. "I didn't suspect anything."

And it's not just renters getting swindled -- landlords appear at risk, too. In another recent incident, Georgia resident Robert Fulton claimed that he got scammed out of $2,200 by a pair of prospective renters after he'd posted an ad on Craigslist to lease out his empty basement.

The pair reportedly sent him a $3,500 check as an advance on the rent, then asked him for a favor. Fulton claims that they requested he send the $2,200 they had "overpaid" him to an acquaintance of theirs to help "cover moving expenses." Though Fulton says that he had his suspicions, he went through with the transaction as the first check appeared to have cleared.

But it hadn't.

"A couple weeks later I got an email from the bank saying the check was no good," Fulton told WSB-TV. He told the television station that after he'd called the scammers about their ploy, they propositioned him to join them in making counterfeit checks, just like the one they'd allegedly used to rip him off in the first place.

"They said, 'Why don't you get involved with us and you can make some money? You can make all your money back,' " Fulton said.

But experts are skeptical that such duped consumers will ever see that money again.

An Online Money Trap

"Unfortunately, it's not likely Fulton will get his $2,200 back," Janet Hart from the Better Business Bureau told AOL Real Estate. "It's probably in another country and he doesn't even know about it. Wire transfers are irretrievable."

Hart, an expert on consumer fraud, reveals that sadly, Craigslist real estate scams are still happening very frequently. Cashing in on fake advance rent checks, like in Fulton's case, is one of the "most popular" Craigslist scams, she says, along with selling and renting "fake" homes. (That's advertising unlisted homes for bargain prices to out-of-town buyers who cannot physically check on the home, and then asking for a "holding fee" to be wire-transferred to an account, like in the Shives' case.)

How to Protect Yourself

Hart warns consumers that diligence is key. You can help safeguard yourself from these scams by avoiding any wire transfers, unless it is to or from a large and reputable organization. Also, if someone's offering you a lot more money than you're asking for in a simple real estate transaction, just don't take it.

"If it sounds too good to be true, it probably is," Hart advises.

AOL Daily Finance also advises that if you are renting a place online and cannot physically see the place for any reason, at the very least you should Google the home's address and do some online research on the property before forking over any money. If the home shows up as a "for sale" home, there could be a problem.

"You can never be too careful," Hart adds. "Ask around and do your research before any online transaction, especially with things involving a lot of money like houses and cars."

I am posting an article that tells more about this common scam.

But experts warn that convenience can sometimes come at an unexpectedly high price, particularly for those who turn to free classified sites like Craigslist for real estate-related transactions. Despite the media spotlight on the dangers of Craigslist in recent years, it appears that online rental scammers are still out in full force, preying on unsuspecting renters and landlords alike.

Just this January, a couple from Lynchburg, Va., were scammed out of $1,000 and confronted by the police because of a fake rental listing they'd responded to on Craigslist.

Two days later, police officers showed up at the Shives' "new home," demanding that they leave. It turns out that, while the home was legitimately listed for rent on the market, the unscrupulous party that advertised the rental on Craigslist was not the rightful landlord. The police informed the couple that the scammer had broken into the home and posed as the rightful owner only to make off with their deposit.

"They just made it sound believable," Faith told CBN News. "I didn't suspect anything."

And it's not just renters getting swindled -- landlords appear at risk, too. In another recent incident, Georgia resident Robert Fulton claimed that he got scammed out of $2,200 by a pair of prospective renters after he'd posted an ad on Craigslist to lease out his empty basement.

The pair reportedly sent him a $3,500 check as an advance on the rent, then asked him for a favor. Fulton claims that they requested he send the $2,200 they had "overpaid" him to an acquaintance of theirs to help "cover moving expenses." Though Fulton says that he had his suspicions, he went through with the transaction as the first check appeared to have cleared.

Search Millions of Home Listings

View photos of homes for sale and apartments for rent

See Homes for Sale on AOL Real Estate

See Rental Listings on RentedSpaces

But it hadn't.

"A couple weeks later I got an email from the bank saying the check was no good," Fulton told WSB-TV. He told the television station that after he'd called the scammers about their ploy, they propositioned him to join them in making counterfeit checks, just like the one they'd allegedly used to rip him off in the first place.

"They said, 'Why don't you get involved with us and you can make some money? You can make all your money back,' " Fulton said.

But experts are skeptical that such duped consumers will ever see that money again.

An Online Money Trap

"Unfortunately, it's not likely Fulton will get his $2,200 back," Janet Hart from the Better Business Bureau told AOL Real Estate. "It's probably in another country and he doesn't even know about it. Wire transfers are irretrievable."

Hart, an expert on consumer fraud, reveals that sadly, Craigslist real estate scams are still happening very frequently. Cashing in on fake advance rent checks, like in Fulton's case, is one of the "most popular" Craigslist scams, she says, along with selling and renting "fake" homes. (That's advertising unlisted homes for bargain prices to out-of-town buyers who cannot physically check on the home, and then asking for a "holding fee" to be wire-transferred to an account, like in the Shives' case.)

How to Protect Yourself

Hart warns consumers that diligence is key. You can help safeguard yourself from these scams by avoiding any wire transfers, unless it is to or from a large and reputable organization. Also, if someone's offering you a lot more money than you're asking for in a simple real estate transaction, just don't take it.

"If it sounds too good to be true, it probably is," Hart advises.

AOL Daily Finance also advises that if you are renting a place online and cannot physically see the place for any reason, at the very least you should Google the home's address and do some online research on the property before forking over any money. If the home shows up as a "for sale" home, there could be a problem.

"You can never be too careful," Hart adds. "Ask around and do your research before any online transaction, especially with things involving a lot of money like houses and cars."

Subscribe to:

Posts (Atom)